One of the major reasons for the credit crisis of 2008 was US consumers over extending their debt levels. All types of personal debts such as credit card debt, mortgages, auto loans, home equity loans and others reached historical levels before the credit bubble burst. With stagnant rises in wages for years the debt to income ratio was unsustainable. After the credit crisis, US households started the painful process of deleveraging in order to repair their balance sheets. However recent data suggests that US consumers are slowly going off the deleveraging path and are taking on more debt.

From an article titled “Credit card use is on the rise” published by CNNMoney last month:

Credit cards are making a comeback.

At the end of 2008, more consumers were using debit cards than credit cards but now that trend has reversed, said Silvio Tavares, senior vice president at First Data, which processes card transactions for 4.1 million merchant locations.

“Credit is back in favor,” he said. “Consumers have spent the last couple of years de-leveraging and reducing credit card use, but during the past month — and since April [of this year] — they’ve been using their credit cards more and are starting to return to pre-recession buying habits.”

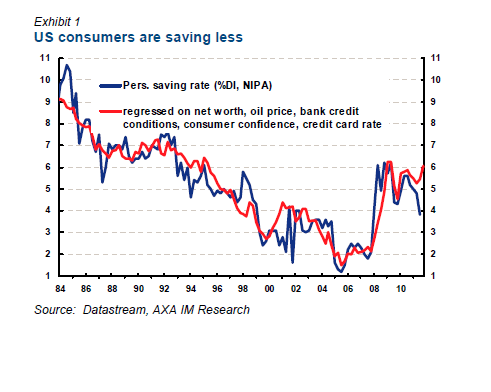

The personal savings rate which increased from 2008 declined again in 2011 as shown in the chart below:

In addition, the pace of deleveraging by consumers seems to have reduced further last year according to an Investment Strategy Special 2012 Outlook report by AXA Financial. This is because consumers used their savings to acquire financial assets instead of paying down their debt. Also while households continued to pare their mortgage debt they actually piled up new consumer debt. This is in line with the sharp increase in consumer debt reported by the Fed in the monthly consumer finance report.

The AXA report further added:

Growth in 2011 has therefore been boosted by a drop in the savings rate, at the cost of delaying the return to healthy household balance sheets. If this growth sweet spot leads to improved business and household confidence, a virtuous circle could ensue, which could end up lifting the housing market from its current stagnation and alleviate the negative equity plague. On the other hand, delaying the deleveraging of households prolongs the vulnerability of the US economy to external shocks. As the European crisis drags on into 1H12, US banks may well be forced to tighten their credit conditions and return households to their previous deleveraging path.

Hence while the US economy is improving in the short-term, a sustained growth to prosperity in the long-term requires consumers to deleverage further and not take on additional debt. Going back to previous ways of gorging on easy credit is not healthy for the both the consumer and the economy.

Related:

Consumer Spending in U.S. Stalls (Bloomberg)