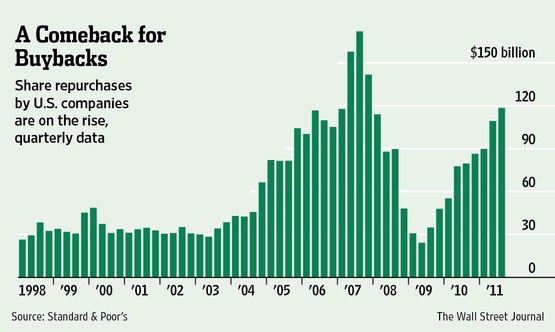

Stock buybacks by U.S. companies has reached record levels. Flush with billions in cash many companies have figured out that the best way to spend those funds is to simply buy their own shares.

The following chart from a recent Wall Street Journal article shows the gradual rise in share buybacks since the market lows of 2009:

Click to enlarge

From the article:

Among companies in the Standard & Poor’s 500-stock index, repurchase spending totaled at least $437 billion last year, a 46% increase from 2010, estimates Howard Silverblatt, senior index analyst at S&P.

Share buybacks rarely benefit shareholders. Instead of paying dividends or making capital investments, companies take the easy way and implement share buybacks.Unlike other countries, the phenomenon of companies buying and sometimes trading in their own shares is very high in the U.S. Short-term mentality of managements, stock options and other factors drive companies to boost stocks price at all costs including spending excess cash on the balance sheet on share buybacks.

The reason usually given by managements for share buybacks is that the stock is undervalued. But in reality it just shows that managements are unable to find better uses for the cash. Just like any other investor, companies also cannot accurately determine if their stock is undervalued and also they cannot predict the future direction of the stock. Despite the odds of being right so negligible, companies buy their own shares anyway hurting shareholders. So generally it is a wise idea to avoid companies that implement share buybacks.

A recent article by CNBC confirms the theory that most share buybacks don’t benefit shareholders. From the article titled “Most Share Buybacks Don’t Pay Off for Investors“:

With cash at record levels, stock buybacks are an increasingly popular way to use free cash flow.

Investors often equate buybacks with management’s belief that the company is undervalued by the market, and purchases can significantly affect the performance of a company stock if the timing is right. But Thomson Reuters’ data shows that’s not always the case.

According to the report, out of 380 companies in the S&P 500 that repurchased shares in at least five of the quarters, 84 companies bought shares when the stock price was high, and only 60 firms were able to buy low.

In addition, 72 companies saw poor returns within a year following share repurchases, versus 57 that saw good results.

The findings point to a combination of bad market timing as well as policies that increase buybacks when companies have more free cash flow.

“This may be partially explained by the need for officers of public companies to make some use of the cash on hand, including keeping less of it due to the possibility of being taken over,” says the report.

Very few companies that have implemented share buybacks have seen their share prices rise consistently and benefit investors. International Business Machines Corp. (IBM) is one company that I can think whose share buybacks has benefited investors. Last October a Bloomberg article noted that IBM plans to spend $50 billion on buybacks through 2015.

Disclosure: No Positions