At the beginning of this year the S&P 500 index stood at 1257. Over the last 10 months the index has experienced extreme volatility and closed today at 1,251. Similarly the index started at 1,320 in the year 2001 which is higher than where it ended today. Hence some investors may have the following question in their minds: Does it makes sense to invest in stocks in such low growth periods?.

In my opinion, the answer to the above question is an absolute yes. The important point is to identify and invest in high quality companies that will grow their earnings and deliver a positive return regardless of the performance of the overall market. An article by Henno Vermaak of PSG Asset Management explains this theory using the example of the JSE All Share Index, South Africa’s main equity index.

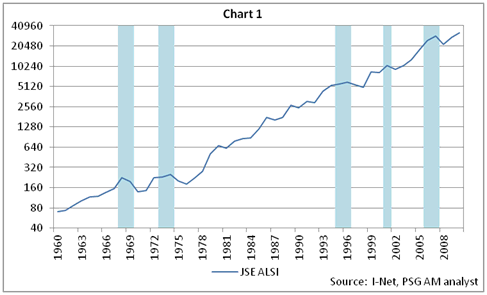

The following chart shows the performance of the JSE All Share Index since 1960:

Click to enlarge

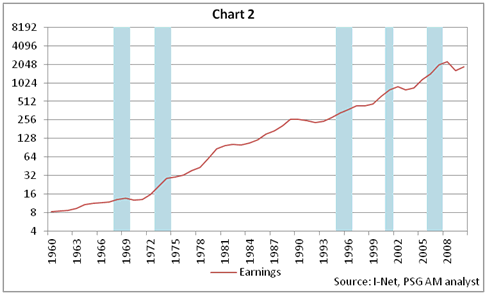

The chart below shows the profits generated by index constituents over the same period as in the chart above:

Note:

1. A low growth market can be defined as a period during which a new investment in an equity index fails to deliver a positive capital return over a period of at least 2 years.

2. The shaded areas represent the extended low growth markets.

From the PSG Angle article:

It might come as a surprise to note that that during each of these periods of low growth markets, the earnings of the index continued to grow. During the period of 2006 to 2008, earnings continued to grow at an annualised rate of more than 25% and from 1973 to 1975, the rate was more than 30% p.a. These rates are not what one would normally classify as low growth!

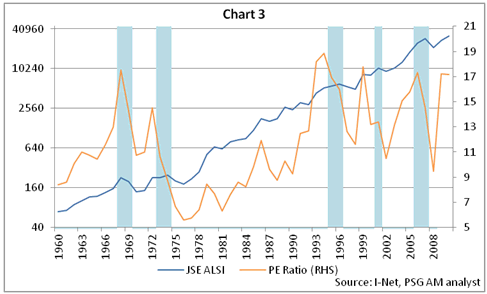

Why then did investors experience negative returns? What happened was that these were periods of significant PE compression.

The P/E ratio of the index since 1960 is shown below:

During periods of low growth investors’ fear lead to lower P/E ratios while during good times P/E ratios expand as investors are willing to pay higher prices.

So to reiterate, investors should invest in equities even when the overall market goes sideways or down for an extended period of time.

Source: PSG Angle. The PSG Angle is an electronic newsletter of PSG Asset Management. To subscribe or read more, please go to to www.psgam.co.za

Ten high quality U.S. stocks from various sectors that investors can consider adding to their portfolios are listed below:

1.Company: Exelon Corp (EXC)

Current Dividend Yield: 4.66%

Sector: Electric Utilities

2.Company: Abbott Laboratories (ABT)

Current Dividend Yield: 3.52%

Sector: Biotechnology & Drugs

3.Company: Chevron Corp (CVX)

Current Dividend Yield: 3.03%

Sector: Oil & Gas – Integrated

4.Company: Norfolk Southern Corp (NSC)

Current Dividend Yield: 2.27%

Sector: Railroads

5.Company: Dow Chemical Co (DOW)

Current Dividend Yield: 3.55%

Sector: Chemical Manufacturing

6.Company: General Mills Inc (GIS)

Current Dividend Yield: 3.08%

Sector: Food Processing

7.Company:Altria Group Inc (MO)

Current Dividend Yield: 5.90%

Sector: Tobacco

8.Company: AT&T Inc (T)

Current Dividend Yield: 5.85%

Sector: Telecom

9.Company: McDonalds Corp (MCD)

Current Dividend Yield: 2.95%

Sector: Restaurants

10.Company: Caterpillar Inc (CAT)

Current Dividend Yield: 1.91%

Sector: Construction & Agricultural Machinery

Note: Dividends noted above are as of Nov 12, 2011.

Disclosure: Long GIS, NSC.