The U.S. has one of the lowest individual income tax rates among the developed countries. For example, the top individual tax rate used to be 91% in 1960. For the 17 years from 1965-1981, the top individual marginal tax rate was 70%. However President Ronald Reagan reduced it drastically from 70% to 28%. Currently the top individual tax rate stands at just 35%. This is lower than the rate in most European countries especially in Scandinavian countries which have some of the highest tax rates in the world.

The very low tax regime in the US disproportionately benefits the wealthy. Hence it is not surprising to see that the majority of the Forbes The World’s Billionaires list are Americans. For example, Forbes puts the net worth of Bill Gates at $56 billion and Warren Buffet at $50 billion as of March 2011. Mr. Buffet famously stated in 2006 that he paid an income tax of 15.5% on his income of $46 million while his secretary paid 30% as tax on her $60,000 income. Since then the situation has gotten worse with the nation’s wealth gushing up into the hands of these few elites rather than trickling down to the millions of working-class Americans. One side effect of this system has been the disastrous increase in deficits in the past few years.

Recently President Obama announced plans to reduce the bloated deficit. The congressional committee on deficit reduction ( also called as the “supercommittee”) is supposed to come up with a compromise before the Thanksgiving deadline. In a report released last week, Center on Budget and Policy Priorities states that the committee must consider revenue increases and spending cuts in order to produce a balanced plan. The authors of the report offer the following five reasons to justify their argument:

- “Spending cuts alone can’t do the job.

- The 2001-2003 tax cuts are a significant contributor to projected deficits. Letting some or all of those tax cuts expire would make a significant contribution to reducing the deficit.

- Higher-income people can and should share in the sacrifices needed to reduce long-term deficits.

- Taxes are low both in historical terms and in comparison with other countries.

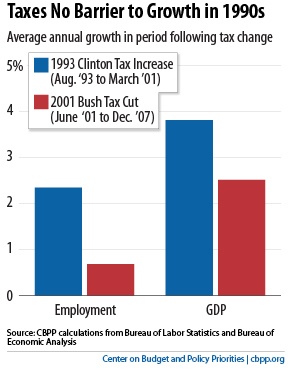

- Higher taxes are not an inherent barrier to economic growth.”

Source: “Supercommittee” Should Develop Balanced Package of Tax Increases and Spending Cuts,

Center on Budget and Policy Priorities