Ever since the Global Financial Crisis (GFC) of 2008, investors’ confidence in the global banking industry has declined tremendously. In the developed world, banks are still saddled with unknown losses mostly tied to real estate and derivatives despite billions of dollars pumped into them as part of the various bailout programs after the crisis.Though emerging market banks have not been crushed like their peers in the developed world, they also suffer from erosion in investor confidence and other issues like capital costs, exposure to the real estate sector, rising default rates, etc.

From the McKinsey Annual Review on the banking industry report:

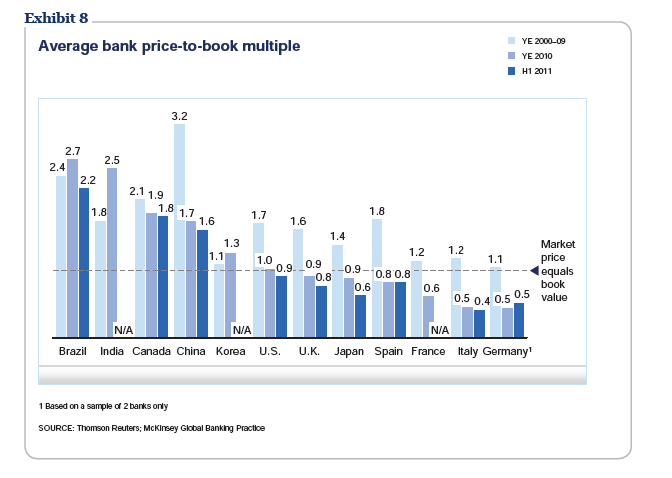

After a rebound in 2009, banks’ total market capitalization remained flat overall in 2010 and the first half of 2011, with gains in many developing markets offset by declines in the US, China, and Western Europe. In both developed and developing markets, banks’ price-to-book ratios fell sharply during 2008-09, failing to recover during 2010 or the first half of 2011. This reflected the market’s view not only that profits would remain depressed, but also that banks would struggle to remunerate their required capital (Exhibit 7). There was also continuing divergence between developed and developing market banks’ price-to-book ratios. By mid-2011, even before the recent turmoil, banks’ market prices were below their book values in several developed countries, including the US, UK, Japan, France, Italy, and Germany (Exhibit 8).

Click to enlarge

After the recent fall, some European banks have gotten cheaper based on P/B and other factors. However one has to be extremely selective. One idea is to consider to banks outside of the Euro Zone such as select Nordic banks. Among U.S. banks, some small and regional banks are worth looking into. For example, U.S Bancorp(USB) offers many compelling reasons to invest as noted in an article in The Globe and Mail. In the emerging markets, some of the bank stocks that investors can review include: Banco Santander Chile (SAN), Banco do Brasil SA (BDORY), HDFC Bank Ltd (HDB) and Malayan Banking BHD (MLYBY).

Disclosure: Long USB