The S&P 500 is down 10.7% YTD. Among the sectoral indices, the financials are the worst performers with the KBW Bank Index off 32% YTD.

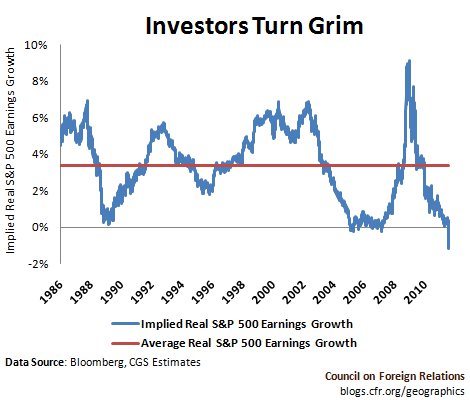

As U.S. equities continue their downward trend, some investors are wondering if they are cheap now. The following chart from a CFR report shows that stocks are either cheap or the market is assuming corporate earnings growth to be sluggish in the future:

Source: Are Stocks Cheap?, CFR

From the CFR report:

As the figure above shows, equity prices of late imply the worst earnings growth rate expectations in 25 years—such expectations even turned negative last week. This dour outlook stems partly from renewed risk-aversion, which ironically redirected cash into downgraded U.S. debt, but it also reflects a sharp rise in concerns about where new profits will come from. Operating margins and profits are near all-time highs, but revenues are still below their 2008 peak and real consumer spending has grown by only 2% over the past year. Corporations currently have strong balance sheets and the lowest net debt-to-revenue ratio on record, but this is largely the result of cost-cutting which may have run its course. In short, either stocks are very cheap or growth prospects very dim.

Currently the PE Ratio for S&P 500 stands at 19.39 and the Dividend Yield for the index is at 2.17%. While the U.S. and the developed world economies remain stuck in neutral or have negligible growth emerging markets are still growing at a robust pace. So investors looking to add some equities to their portfolios can consider adding U.S. companies which have high exposure to emerging markets and do not depend heavily on the domestic market. A list of 25 such companies can be found here.

Related ETF:

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions