On August 5th, the ratings agency Standard & Poors downgraded U.S. debt from AAA to AA+ for the first time in 70 years. This is the same agency that rated worthless junk such as sub-prime paper as AAA before the credit crisis began in 2008. In a way the standard followed by Standard & Poors is poor to say the least.

Long before this S&P downgrade, in July of last year China’s leading rating agency Dagong stripped the USA, Britain, France and Germany of their AAA ratings. However not many in the west paid any attention to this.

From an article in The Telegraph:

Dagong Global Credit Rating Co used its first foray into sovereign debt to paint a revolutionary picture of creditworthiness around the world, giving much greater weight to “wealth creating capacity” and foreign reserves than Fitch, Standard & Poor’s, or Moody’s.

The US falls to AA, while Britain and France slither down to AA-. Belgium, Spain, Italy are ranked at A- along with Malaysia.

Meanwhile, China rises to AA+ with Germany, the Netherlands and Canada, reflecting its €2.4 trillion (£2 trillion) reserves and a blistering growth rate of 8pc to 10pc a year.

Dagong rates Norway, Denmark, Switzerland, and Singapore at AAA, along with the commodity twins Australia and New Zealand.

In late July of this year, Egan-Jones Ratings Co, a rating Company based in Haverford, Pa downgraded U.S. debt but nobody attention either according to an article in The Wall Street Journal. In fact, there are 10 rating agencies in the U.S. as shown in the graphic below:

But Standard & Poors, Moody’s and Fitch have a 95% U.S. market share. These three firms effectively operate as a monopoly due to years of consistent support by Uncle Sam. Hence when the other little guys issue ratings they are pretty much ignored by the media and others. Just like telecom, airlines, media, rail, auto manufacturing, credit reporting agencies (on individuals) and other industries a handful of companies in the rating industry have a formed a oligopoly. While U.S. oligopolies in other sectors do not have much influence on foreign countries, the three rating agencies have tremendous power over countries and companies around the world making them both feared and respected at the same time.

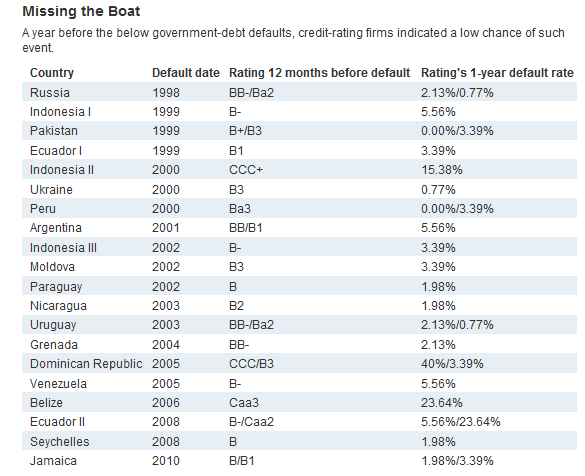

In addition to slapping AAA rating on questionable paper, the rating agencies have fared poorly in predicting default rates on government debt. From a Journal article titled Raters Fail to See Defaults Coming:

Source: The Wall Street Journal