The global financial crisis of 2008-09 started in the U.S. and almost brought the world’s economies to its knees. With the downgrade of the U.S. by S&P and the crash in global markets today it appears that the U.S. might trigger another financial crisis soon if one has not started already.

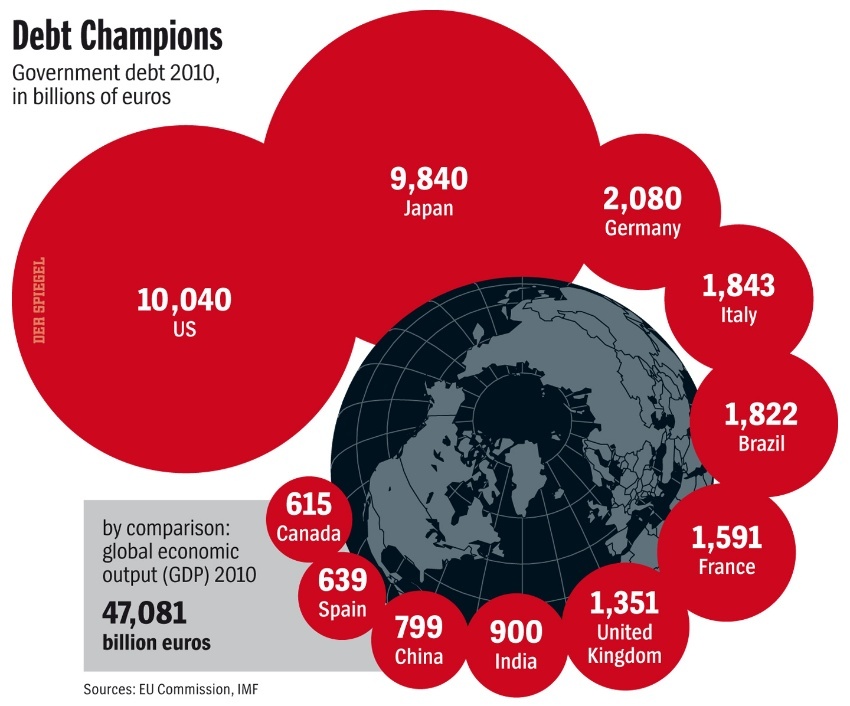

I came across this graphic showing the world’s most indebted nations:

Click to enlarge

Source:Is The World Going Bankrupt?, De Spiegel

The article notes that the world lacks the political leadership needed to end the current turmoil. This statement can’t be further from the truth especially with respect to the U.S. leadership. After the S&P downgrade, President Obama made a statement hoping that would somehow calm the markets. He even stated that “no matter what some agency may say, we’ve always been and always will be a AAA country.” However the market tanked much more after this statement underscoring the gap between market’s views of the U.S. fiscal issues and the views held by this administration.

From A crisis of confidence in economy — and Obama by James Pethokoukis of Reuters:

In short, there is again a crisis of confidence in the U.S. economy – but in Washington, too. During his brief speech yesterday at the White House, Obama did nothing to calm jittery markets, perhaps achieving just the opposite. He blamed Tea Party Republicans for the debt downgrade. He said government discretionary spending couldn’t be cut much further. He called for raising taxes. And he repeated his demand for a mini-version of the 2009 stimulus – temporary tax cuts, infrastructure spending, more unemployment benefits.

The stock market, already falling before Obama spoke, saw selling accelerate as Obama made it clear he had no new ideas to offer. And he certainly gave no hint that he’s ready to adopt Republican ideas such as cutting business taxes or slashing regulation. Instead of a pivot, Obama stayed firmly planted in the anti-growth policies of the past two-and-a-half years. He’s even keeping Tim Geithner as Treasury secretary, practically begging the poor guy to stay. (Indeed, it was almost exactly a year ago that Geithner penned his “Welcome to the Recovery” op-ed.)

If confidence is not restored quickly and the market continues to fall the President’s hopes of winning a second-term may have to be set aside.