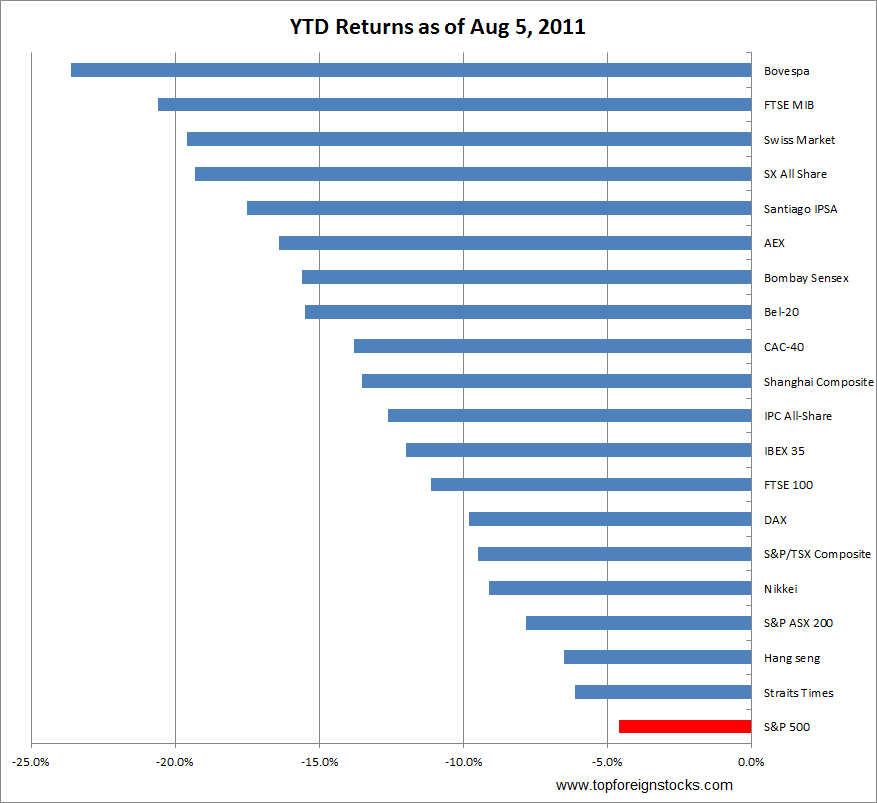

The chart below shows the year-to-date(YTD) performance of the S&P 500 and the major indices of most global markets:

Click to enlarge

Some observations:

- With a loss of 4.6% YTD for the S&P 500, U.S. stocks are relatively performing better than the stocks of other developed economies.

- Equities in Italy and Spain have entered the bear market territory as the FTSE MIB and Bovespa indices are off by more than 20% YTD.

- Germany, home of the largest and strongest economy in Europe, is down by 9.8% as noted by the DAX index compared to double digit losses of the British, French, Spanish, Swiss indices.

- In addition to Brazil, the emerging countries of India(Bombay Sensex) and China(Shanghai Composite) are also down more than 10% YTD.

- The commodity-based developed economies of Canada (S&P/TSX Composite) and Australia (S&P ASX 200) are off more than the U.S. but still lower than the crisis-ridden European countries.

Related ETFs:

iShares MSCI Canada Index (EWC)

iShares MSCI Australia Index (EWA)

SPDR S&P 500 ETF (SPY)

iShares MSCI Emerging Markets Indx (EEM)

iShares S&P India Nifty 50 (INDY)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

iShares MSCI Brazil Index (EWZ)

Disclosure: No Positions