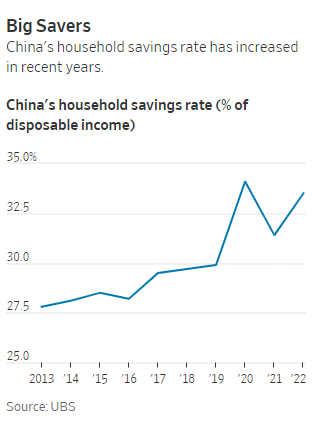

China’s savings rate is one of the largest in the world even in dollar terms. Chinese tend to save a higher proportion of their incomes due to the lack of social safety nets such as healthcare, social security and other state-provided benefits.

From a recent IMF report on China:

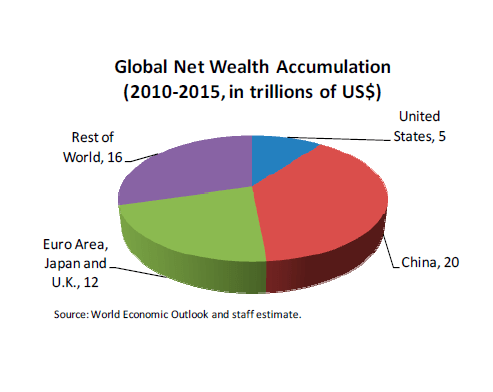

On account of its large annual saving, China is projected to contribute more than 1/3rd of global net wealth accumulation between 2010 and 2015 (measured as net investment plus increase in net foreign assets). China’s allocation of this new wealth should have increasingly important, if gradual, implications for domestic and global financial markets.

What will the impact of this saving on asset prices?

Due to capital controls and an undervalued currency, among other factors one of the major impact of China’s large savings would be asset price inflation both in the domestic economy and in foreign markets.

As of May this year China holds $1.1 Trillion of U.S. debt according to U.S. Department of the Treasury, making China the largest holder of U.S. debt.

U.S. Debt position:

As the world’s largest debtor country, the U.S. currently owes $14.3 Trillion in debt to both Americans and foreigners. However despite $4.5 Trillion held by foreign countries including the $1.1 Trillion held by China, the vast majority of the U.S. debt held is the American public.

The U.S. Congress is trying to reach a deal to raise the $14.3 trillion debt ceiling before the government runs out of cash by August 2. From an article on Debt Limit by the U.S. Department of the Treasury:

The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments. The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past.

Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations – an unprecedented event in American history. That would precipitate another financial crisis and threaten the jobs and savings of everyday Americans – putting the United States right back in a deep economic hole, just as the country is recovering from the recent recession.

Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. In the coming weeks, Congress must act to increase the debt limit. Congressional leaders in both parties have recognized that this is necessary.

Sources:

The Spillover Report and Selected Issues, July 2011, IMF

U.S. Department of the Treasury