Equity markets of emerging and developed countries perform differently due to obvious reasons. During the credit crisis, the theory that emerging markets are decoupled from developed markets was proven wrong when equities worldwide plunged in a synchronized fashion. In fact, emerging equities fell higher than developed equities. However over a 5-year period, some of the emerging markets are well ahead of developed markets.

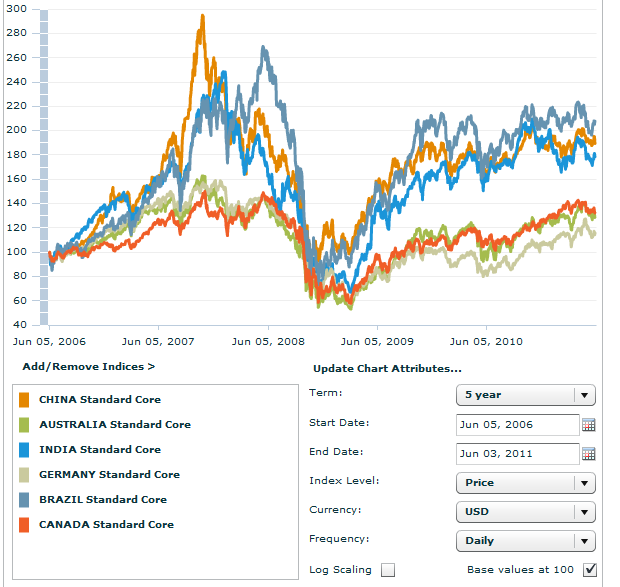

The chart below the performance 5-year comparison of select developed and emerging countries using the MSCI country indices:

Source: MSCI

Brazil, China and India are have much performed better than the developed countries of Australia, China dn Germany. The MSCI index 5-year returns for these countries are noted below:

- Brazil = 14.98%

- India = 11.84%

- China = 13.89%

- Canada = 5.30%

- Australia = 5.32%

- Germany = 2.76%

It is interesting to note that Canada and Australia have almost similar returns. Both the countries have natural resource-based economies with Canada dependent heavily on the U.S. and Australia feeding China’s voracious appetite for iron ore, coal, etc. As commodities boomed in the past few years the economies of Canada and Australia benefited considerably. Despite having a strong export-based economy Germany has lagged in performance in the past 5 years.

Another takeaway from this chart is that investors need to diversify their holdings across many asset classes and markets. Though emerging markets are lagging this year they may indeed outperform developed markets in the long-term such as a five or ten year time horizon.

Related ETFs:

iShares MSCI Emerging Markets Indx (EEM)

iShares MSCI Brazil Index (EWZ)

iShares FTSE/Xinhua China 25 Index Fund (FXI)

iShares MSCI Germany Index Fund (EWG)

iShares MSCI Canada Index Fund (EWC)

iShares MSCI Australia Index Fund (EWA)

PowerShares India Fund (PIN)

iShares S&P India Nifty 50 (INDY)

Disclosure: No Positions