One of the risks of investing in foreign stocks is the exchange-rate risk. For example, the movement of the domestic currency where the stock is listed against the US dollar can adversely or positively impact the return of that investment for US-based investors. A strengthening of the dollar reduces foreign stock returns to US investors as the local returns becomes less when converted to US dollars. Conversely a weaker dollar leads to higher returns for US investors.

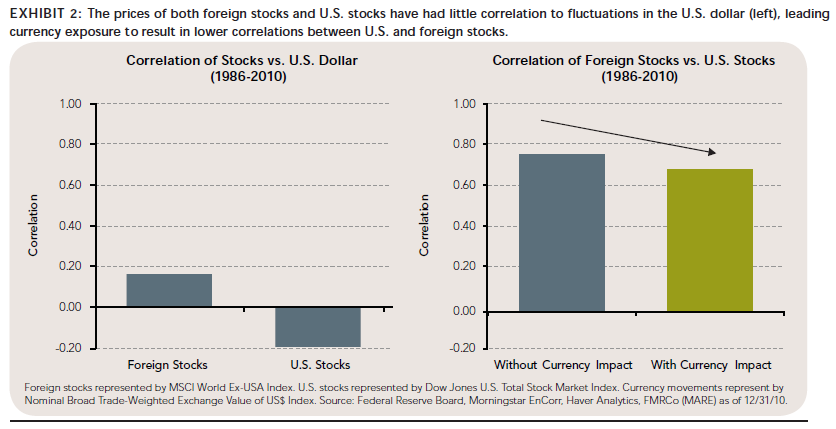

Some investors simply avoid exposure to foreign stocks due to this risk in addition to other factors. However a research report by Fidelity shows that over the long-term currency moves actually benefits foreign stocks and improves the risk-adjusted returns. Despite their ability to influence performance for U.S. investors, currency movements historically have had low correlations with the local-currency-denominated price movements of foreign stocks.For example, during the 25-year period ending in December 2010, the foreign-exchange movement of major foreign currencies had only a 0.16 correlation with the local currency returns of foreign equities. This implies that the price changes of foreign stocks have had very little to no relationship with the movements in the exchange-rate value of the U.S. dollar.

Click to enlarge

Source: Foreign Stocks: Potential Benefits of Maintaining Currency Exposure, January 2011, Fidelity Investments

The impact of currency movements on foreign stocks returns can be significant. For example, in 2010 Australian stocks were roughly flat. But the Australian dollar strengthened against the US dollar. This boosted returns to US investors in Australian stocks leading to a 14.4% gain after the local returns were exchanged into US dollars. On the other hand German stocks rose 16.9% in local currency terms. But due to the weakening of the Euro this resulted a lowering of the returns to just 9.3% in dollar terms to US investors. These examples show that in the short-term currency movements have a strong impact on foreign stock returns. However in the long-term (past 25 years) U.S. stocks have had a modestly negative correlation (-0.19) against foreign-exchange movements.

Hence currency movements can help lower correlations between U.S. stocks and foreign stocks. In the past 25 years foreign stocks had a correlation of 0.75 to US stocks in local currency terms.But when the impact of currency movements is incorporated and returns calculated in US dollars, the correlation was reduced to 0.69. The same effect can be seen for other periods such as 15, 20, 35 years as well.

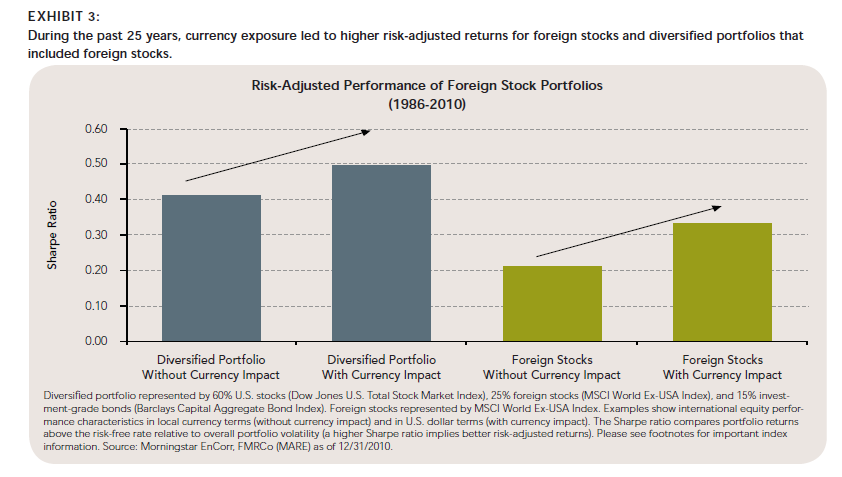

Predicting currency movements is extremely difficult for ordinary investors. In the short-term, they have a big impact on the stock returns for US investors. In the long-term though, the low-correlations between currency movements and stock prices actually helps investors to achieve portfolio diversification benefits, such as lower portfolio volatility and higher risk-adjusted returns.