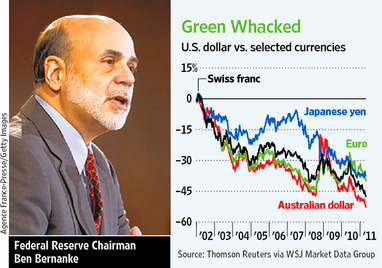

The U.S. dollar has been on a downward spiral for many years now. The following chart makes it clear the severity of the dollar’s plunge against major currencies since 2002:

Source: The Wall Street Journal

As the dollar continues to fall many investors seek the shelter in gold which has driven the price of gold to record levels. From a journal article titled How to Profit From the Shrinking Dollar:

A slumping dollar historically has been good for stocks. The classic stock play during periods of dollar weakness is large-cap companies that export heavily: Companies in the S&P 500 index derive nearly half of their revenues from abroad, notes Howard Silverblatt, senior index analyst at Standard & Poor’s.

Such companies benefit from a weaker dollar in two ways. In the shorter term, profits rise as companies convert their foreign sales into dollars. In the longer term, their products become more competitive in overseas markets, boosting revenue as well.

Barry Knapp, U.S. equity portfolio strategist at Barclays Capital, says big stocks are poised to outperform. He points to the fourth quarter of 2003, when the Federal funds rate hovered at 1%, triggering inflation fears that sent the dollar down 5.8%. The large-cap S&P 500-stock index surged 11.6%.

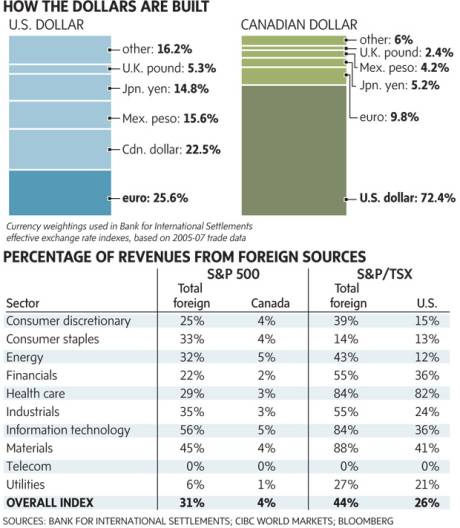

Large-cap technology companies usually see an uptick in their stock price when the dollar flails, says Emily Sanders, chief investment officer at Norcross, Ga.-based Sanders Financial Management Inc. Of the 10 sectors in the S&P 500, information technology generates the highest proportion of revenues outside the U.S.—an average of 57%, notes Ms. Sanders.

She says she especially likes International Business Machines Corp., whose sales increased 8% during the first quarter, with more than one-third of the gain coming from a weakening dollar. Most of her clients own the company in their portfolios.

The surprise lately has been the performance of small and midcap companies—those with market valuations of less than $5 billion. During the past 120 days, midcaps have seen their “correlation” with the ICE US Dollar Index—the degree to which the two trade together—fall to minus-0.76 from minus-0.55. (A correlation of 1.0 means two assets trade in perfect lockstep; a correlation of minus-1.0 means they trade in perfect opposition.)

Small caps—companies with an average market value of less than $1 billion or so—have seen their dollar correlations fall to minus-0.68 from minus-0.53. Large caps’ correlation fell only slightly to minus-0.69 from minus-0.64.

In other words, as the dollar has weakened, midcaps have risen the most: The S&P Midcap 400 index has jumped 12% during the period, while the S&P Small Cap 600 has gained 10% and the S&P 500 is up 8.2%.

In a declining dollar environment which sectors of the equity market offer the best opportunities?

Stocks in the Technology and Materials sectors are the most attractive in the current situation as they have the highest overseas revenues as shown in the graphic below:

Source: The Globe and Mail

Related ETFs:

- iShares Dow Jones U.S. Basic Materials Sector Index Fund (IYM)

- iShares Dow Jones U.S. Technology Sector Index Fund (IYW)

- iShares S&P 500 Index Fund (IVV)

Disclosure: No positions