The real estate market in China has not yet crashed despite being a bubble for many months now. While the Chinese government has had some success in curbing excess speculation in major cities, developers are finding other places to continue their growth and in the process may create bigger bubbles. A recent article in Bloomberg says that Chinese builders are moving to Tier II and Tier III cities for expansion as the cities of Shanghai and Beijing are adversely impacted due to recent government measures to curb wild speculation in the market. From the article:

Cheaper land and rising incomes in inland cities are luring developers as the government targets speculators, focused on Shanghai and Beijing, with stricter mortgage requirements and property taxes. Land investment in less affluent cities jumped 35.4 percent in the past year, according to data from China Real Estate Information Corp., which tracks 40 publicly traded developers.

“Absolutely policy is a driver of this, both because the policy’s footing in more developed cities is stricter and also because there is tremendous unmet demand for modern housing in these second-tier cities where incomes are rising quickly,†said Michael Klibaner, head of China research at Jones Lang LaSalle Inc. in Shanghai.

First-tier cities include wealthier Shanghai, Beijing and Guangzhou, in southern China, according to China’s National Bureau of Statistics. The second tier includes provincial capitals and the third includes smaller cities.

Buying Land

Residential land costs in the central city of Wuhan averaged 1,662 yuan per square meter in January, compared with Beijing’s 4,145 yuan and 5,692 yuan in Shanghai, according to SouFun Holdings Ltd., China’s biggest real estate website.

“Everyone agrees that opportunities lie in second- and third-tier cities, including us,†said Yang Haisong, a Hong Kong-based spokesman for China Overseas Land & Investment Ltd., a state-owned developer. “There are more cities in that category and their home prices have more room to rise.â€

Hong Kong-based China Overseas, which started expanding in the country’s interior five years ago, posted its biggest increase in sales volume in northern China in December. It sold 1.5 million square meters (16 million square feet), a 67 percent jump from the same period a earlier, in the region that includes Shenyang, Changchun, Dalian and Qingdao.

“Top cities are increasingly mature: people are actually going to be second-, third- or fourth-time buyers,†said Wee Liat Lee, a Hong Kong-based property analyst at Samsung Securities Co. “If you go to these lower-tier cities, a lot of them are first-time buyers. You are tapping into fundamental demand, with no restrictions.â€

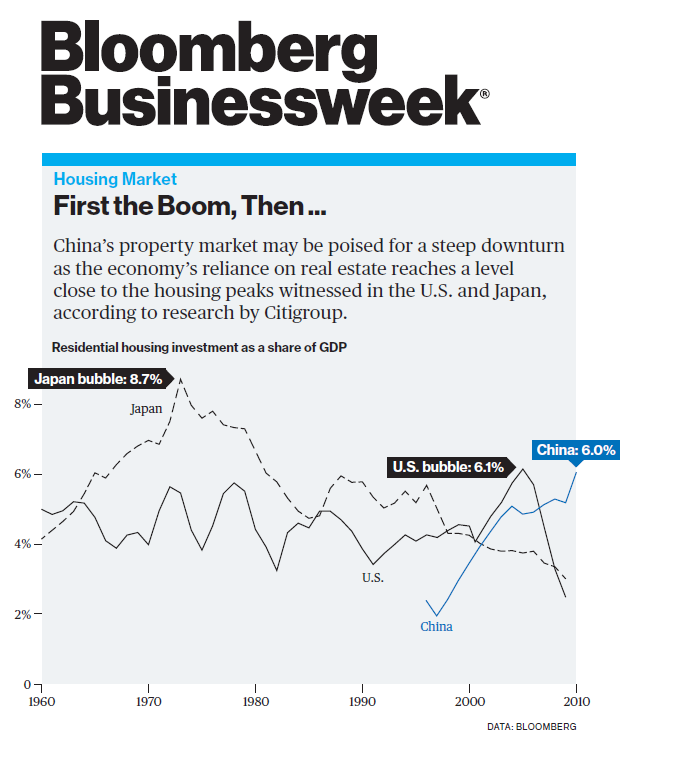

Despite the expected strong growth in the smaller towns and cities across China, investing in the Chinese real estate market is not a good idea now. Based on one measure, the Chinese housing bubble may be poised to pop as shown in the chart below:

Source: Bloomberg BusinessWeek