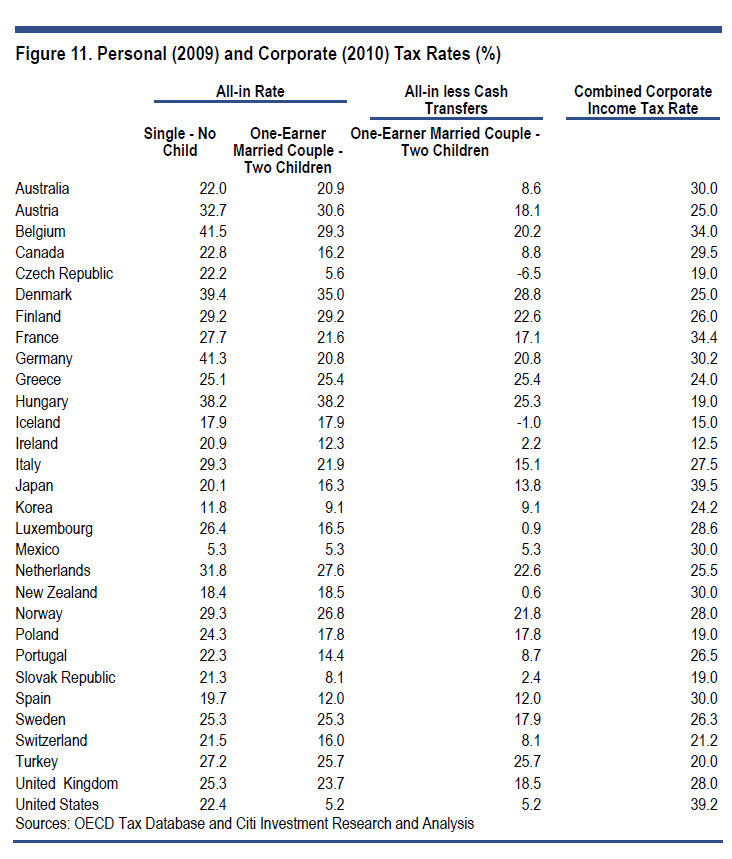

The chart below shows the Personal and Corporate Income Tax Rate for OECD countries:

Click to enlarge

Source: The Debt of Nations, Citigroup Global Markets

Among OECD countries, Japan has the highest corporate tax rate at 39.5%. The U.S. has the next highest rate at 39.2%. However most U.S. companies do not pay taxes at such a high rate. In fact some of them such as General Electric (GE) do not pay any tax at all due to many legal loopholes Uncle Sam allows for corporations to evade taxes. While corporations are considered as “human” according to U.S. laws they are allowed to evade taxes legally but breathing and living “real humans” will be thrown in jail if they try do the same thing. But despite the preferential treatment of corporations, some people consider the high corporate income tax rate in the U.S. as an impediment to economic growth. They would like the rate to be set at levels like other countries such as Ireland with 12.5% or even Canada or UK with rates under 30%.

Disclosure: No Positions