When the global financial crisis began much of the world’s attention was directed towards the U.S. since the country was the main source of triggering the worldwide crisis in financial markets. However recently Europe has been attracting the focus of investors worldwide due to the Euro debt crisis. First it was the tiny economy of Iceland whose banking system collapsed. Then it was followed by Greece, the sick man of Europe, which was bailed out as well. Now Ireland has become the latest European country to be rescued by the EU and IMF.

Despite the high government debt levels in Europe, investors should be more worried about the U.S. debt which stands at $13.8 Trillion and is set to rise further according to IMF graphs shown below. About $9.2 Trillion of this debt is held by the public and the rest is intragovernmental holdings. China is the largest foreign holder of U.S. debt. As of September 2010, China holds $883.0 billion of U.S. Treasury securities.

Click to enlarge

1)

This year many emerging markets tightened their economic stimulus programs. But in the U.S. more funds is being spent with the Fed’s QE2 and on welfare programs.

2)

U.S. debt is higher than Ireland and Greece and will continue to rise in 2011 when it will exceed 99% of GDP. A general rule is that debt over 90% of GDP will suppress growth.

3)

One of the factors noted by IMF that makes countries vulnerable is that how soon their debt becomes due. The chart above shows the average length of US debt is shorter than most European countries such as UK, Norway, Germany, etc.

4)

The blue and yellow bars indicate that about an equal number of Americans and foreigners (non-residents) have loaned money to the U.S. government. This makes the U.S. more vulnerable to crisis since it can be assumed that unlike domestic investors who will be patriotic, foreigners may demand their principal and interest at any time. If the Chinese pull their US investments it will have unimaginable consequences on the US economy. Some countries have low debt ownership by nonresidents. For example, foreign ownership of Canadian government debt is very small compared to the debt owned by Canadians.

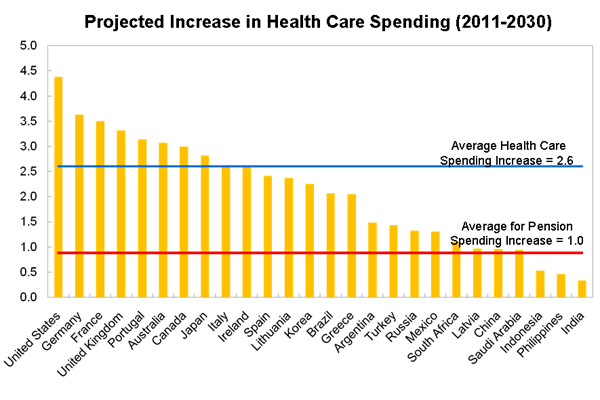

5)

An ageing population means the US government spending on pension and healthcare is set to rise further from current levels.Until now no formal plans have been made on the funding sources for many of the expensive entitlement programs.

6)

According to Carlo Cottarelli, director of the IMF’s fiscal affairs department, investors are unlike to get worried about America’s ability to repay its debt because of its long-standing credibility. But he mentioned that backing for such high levels of debt could have a negative impact on the long-term growth of the US economy.Currently the US has the AAA credit rating.

Source: via CityWire