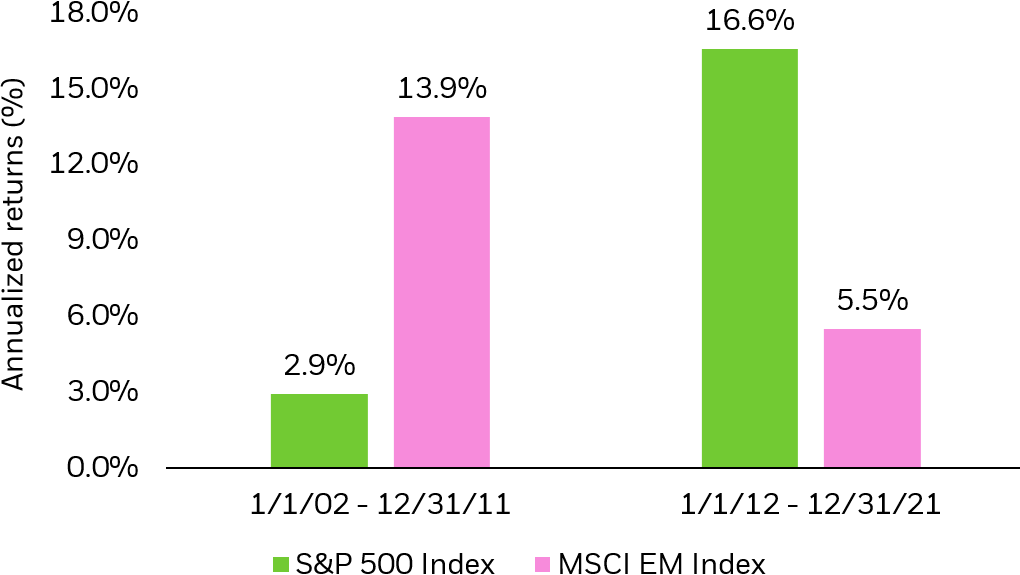

Emerging markets have been growing at an incredible pace in the past few years. Some of these markets have performed well this year also compared to the US. For example, the year-to-date returns of Brazil, India and Mexico are 4.3%, 17.1 % and 5.3% respectively. Despite the strong growth in recent years, emerging markets continue to exhibit potential for further growth. Hence investors might want to diversify their portfolios with some exposure to emerging market equities.

Some of the reasons to invest in emerging markets are discussed below:

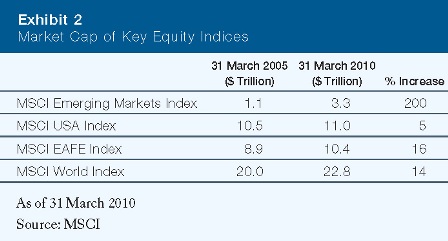

1. The market cap of the MSCI Emerging Market Index has grown 200% in the last 5 years beating all other broad indices as shown in the graphic below:

Source: Lazard via Trustnet

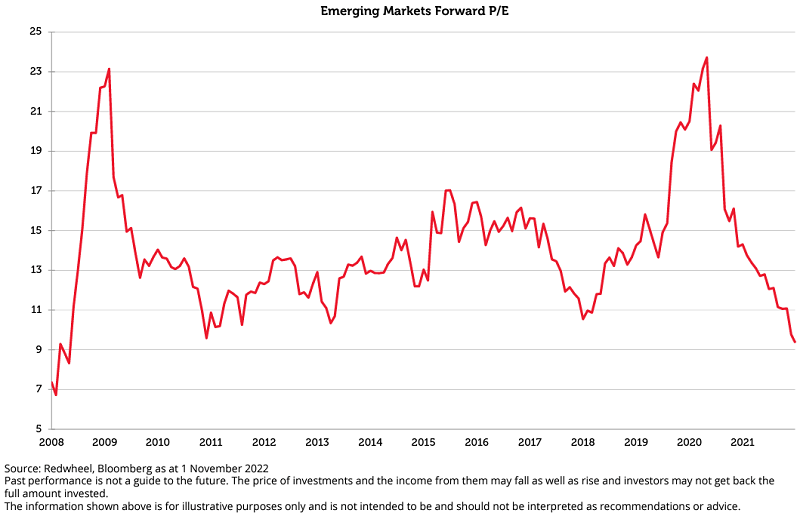

Currently emerging markets trade at 11 times forward earnings compared to 12.5 times for the MSCI World.

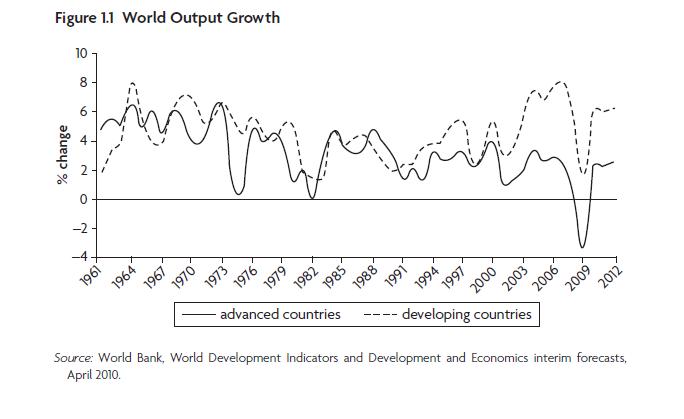

2. Almost half of the global GDP growth comes from developing countries.

3. According to The World Bank estimates, developing countries are projected to grow by 6.1% in 2010, 5.9% in 2011, and 6.1% in 2012, while the corresponding figures for the developed countries are just 2.3%, 2.4% and 2.6%.

4. Developed countries are facing a much stronger headwind compared to emerging countries.Recessions due to a combination of credit crunch, a housing bust, and an equity bust tend to be deeper and longer than usual. OECD data shows that just 4 out of 122 recessions in the post-war period have had all these three factors.Hence emerging countries are in better shape than developed economies since they suffered less from the effects of the credit crisis.

5. Public debt in the advanced G-20 economies is expected to reach 118% of GDP by 2014 whereas developing countries’ debt is projected to decline further.

6. Consumption spending by consumers in developed countries will be weak despite the balance-sheet de-leveraging by households due to the jobless recovery and collpased housing prices.

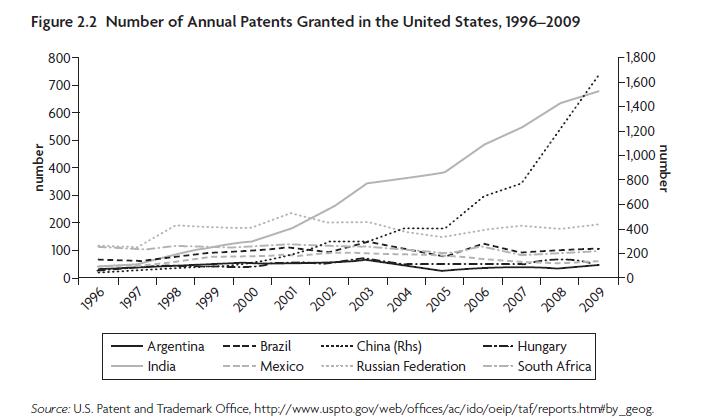

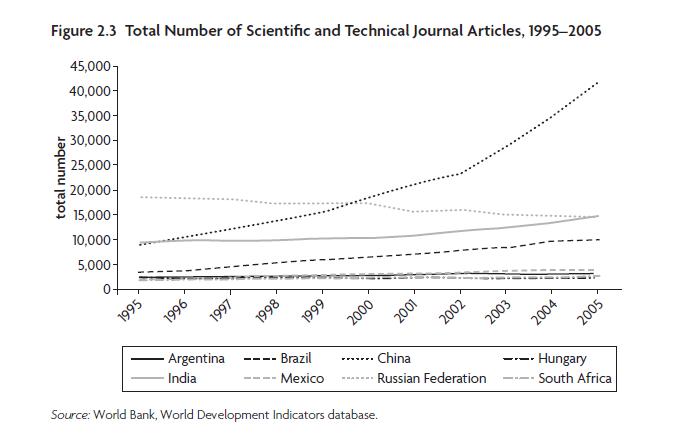

7. Among emerging countries, some countries such as Brazil, China, India are showing an increase in measures of innovation such as number of patents granted and scientific and technical journals published.

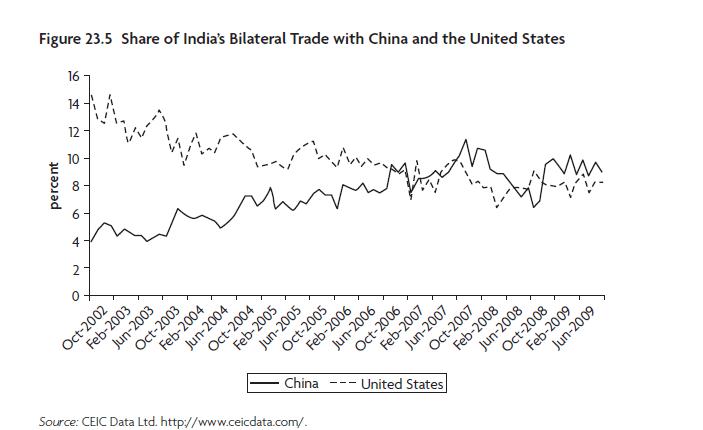

8. Trade among developing countries is increasing significantly. Trade among the developing countries now accounts for about 39% of their total trade. For example, bilateral trade between India and China has been increasing since 2008 and has exceeded the bilateral trade between India and the United States. Furthermore, trade between India and China remained constant during the credit crisis, while trade between India and the United States declined as the chart shows below:

9. As developing countries move up the value chain, they are less dependent on primary commodity exports than before.For example the share of commodity exports has fallen from 50% in 1990s to 40% during 2005-2007.

10. Factors such as infrastructure spending, urbanization, healthcare investments, etc. will lead to higher economic growth in emerging markets relative to developed markets.

Source: The Day After Tomorrow – A Handbook on the Future of Economic Policy in the Developing World by Otaviano Canuto and Marcelo Giugale, The World Bank

Related ETFs:

iShares MSCI Emerging Markets Index Fund (EEM)

SPDR S&P Emerging Markets ETF (GMM)

Vanguard Emerging Markets ETF (VWO)

Many other emerging market ETFs based on a variety of strategies are available for investors.This ETF list can be accessed at the Seeking Alpha site here.