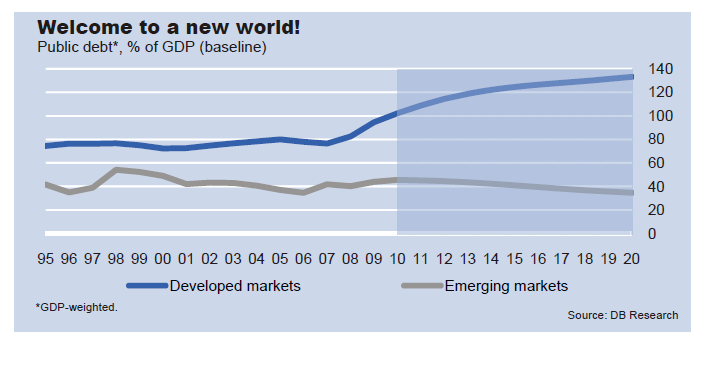

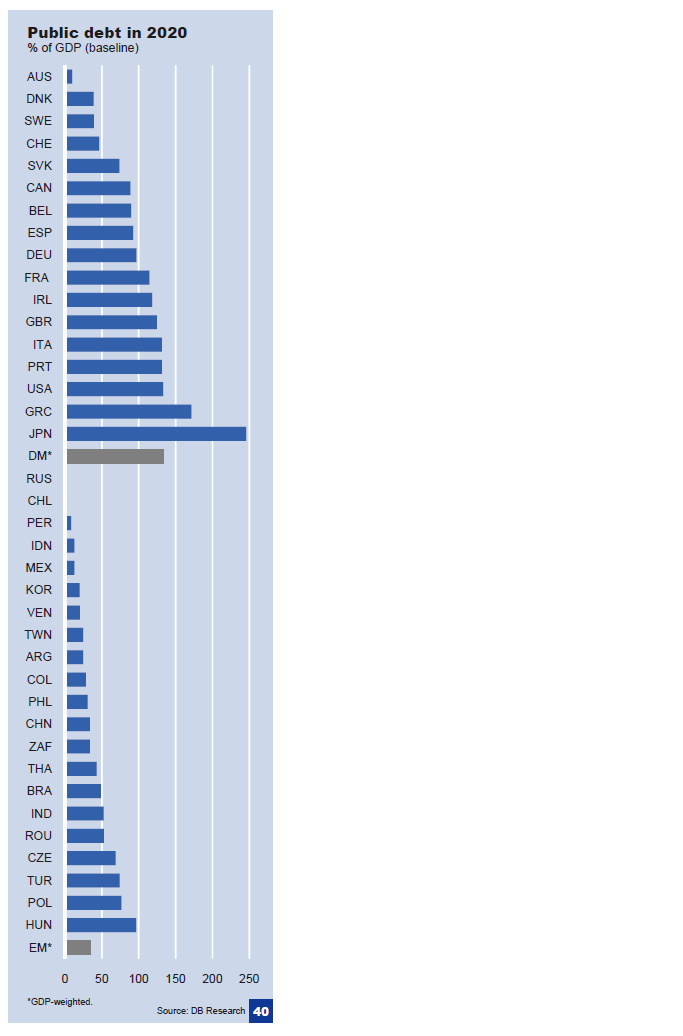

In a study titled “Public debt in 2020”, Deutsche Bank analyzed public debt sustainability in both developed and emerging markets using data for 21 emerging markets(EMs) and 17 developed markets(DMs). The results show that the public-debt-to-GDP ratio is projected to soar from just over 100% this year to 133% in developed markets.

Charts:

The authors of this report conclude:

“Although there is a strong need for medium-term fiscal consolidation in many DMs and a few EMs, one should not forget that expansionary policies mitigated the adverse effects of the global crisis and very likely prevented a collapse of the global financial system and the world economy. At the moment, it appears that a fiscal exit can take place only gradually. Our 2020 scenarios as well as our debt target analysis highlight that public debt has become, or is at least at the risk of becoming, unsustainable in many DMs but only in a few EMs. At least in theory, most EMs could afford to run looser fiscal policies, for instance by extending counter-cyclical fiscal policies in order to smooth the fall-out from the global crisis. Moreover, moderate initial debt levels put them in a relatively

comfortable position to stabilise or even outgrow their debt-to-GDP ratios.”