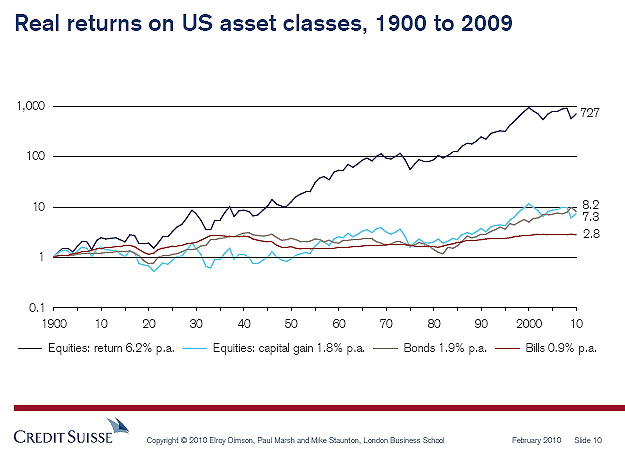

The 2010 edition of the Credit Suisse Global Investment Returns Year Book confirms that equities outperform bonds over the long term. The chart below shows the performance of U.S. stocks, bonds and T-bills from 1900 thru 2009:

A $1,000 invested in U.S. equities in 1900 would be worth $727,000 now. This number is adjusted for inflation. The real rate of return equals to 6.2% which is very good. However it must be noted that the majority of the returns came from dividend reinvestment and not capital appreciation. Capital gains accounted for just 1.8% per year.This study proves again the importance of investing in dividend paying stocks and dividend reinvestment. When compared to stocks, the rate of return on bonds and T-bills is very low.

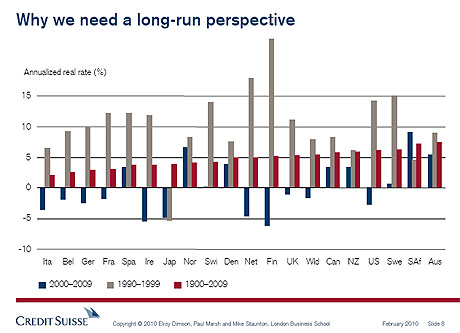

The following graphic shows the rate of return for equities over different time periods:

Source:Â Credit Suisse Global Investment Returns Year Book 2010