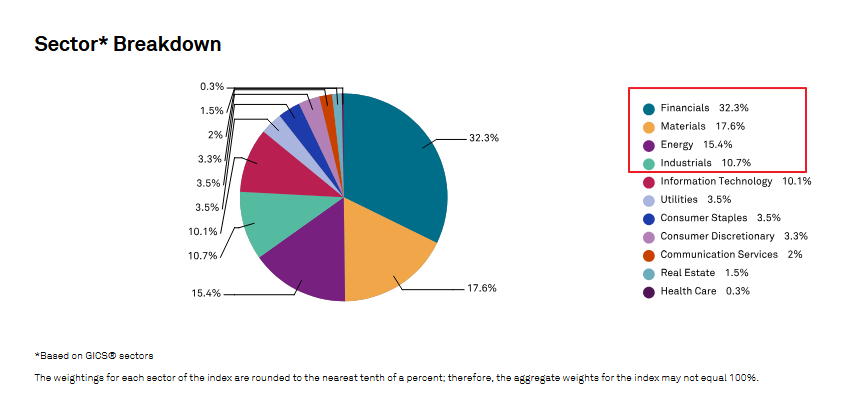

The S&P ADR Index, which tracks some of the large foreign companies traded in the U.S. markets, also includes many ordinary Canadian equities. The top nine energy companies of Canada are listed below. Energy trusts are excluded.

1.Cameco Corp. (CCJ)

Sector: Mining – Uranium

Earnings Growth (5 year): 10.21%

2.Canadian Natural Resources Ltd.(CNQ)

Sector: Integrated oil and gas

Earnings Growth (5 year): 13.85%

3.Enbridge Inc (ENB)

Sector: Oil Well Services & Equipment

Earnings Growth (5 year): 13.85%

4.EnCana Corp. (ECA)

Sector: Integrated oil and gas

Earnings Growth (5 year): 23.61%

5.Imperial Oil Ltd. (IMO)

Sector: Integrated oil and gas

Earnings Growth (5 year): 23.41%

6.Nexen Inc (NXY)

Sector: Integrated oil and gas

Earnings Growth (5 year): 28.21%

7.Suncor Energy Inc (SU)

Sector: Integrated oil and gas

Earnings Growth (5 year): 17.41%

8.Talisman Energy (TLM)

Sector: Integrated oil and gas

Earnings Growth (5 year): 33.99%

9. TransCanada Corporation (TRP)

Sector: Oil

Earnings Growth (5 year): 9.72%

Most of the companies noted above are in the oil and natural gas sector. This sector accounts for one of the large export revenue generators for Canada. Most of the oil and gas exports go to USA, its largest trading partner.The U.S. considers Canada to be an important and secure source of crude oil.

Most of the Canadian crude oil is extracted from the tar sands in Alberta. Calgary, Alberta-based Suncor Energy (SU) acquired Petro-Canada,another large integrated oil company in March this year. Petro-Canada operates gas stations under the same name. Imperial oil operates gas stations under the Esso brand.

Last month, the U.S. State Department granted approval for the construction of the US portion of the Enbridge (ENB) Alberta Clipper pipeline. The pipeline will carry crude oil to the U.S. midwest.The pipeline goes from Hardisty,Alberta to Superior,Wisconsin on the U.S. side costs about $3.7B to build. When completed it will transport 450,000 barrels per day with a maximum capacity of 800,000 per day if required.