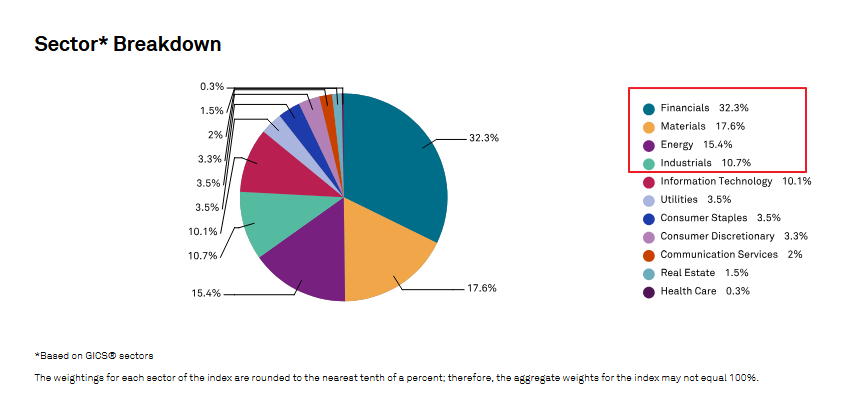

Unfortunately there is none that trades in the US markets. However there is the iShares CDN Financial Sector Index Fund (XFN.TO) listed in the Toronto Stock Exchange (TSX). US investors who have access to TSX, can invest in this ETF to get exposure to the big five Canadian banks and a few other financials.

Many investors are interested in Canadian banks now due to their resilence and strenth during the credit crisis when banks in many developed countries like the US, The Netherlands, US, etc. have failed. The country-specific iShares MSCI Canada ETF (EWC) gives broad exposure to the Canadian markets but does not provide the sector-specific concentration on banks and related financials.

The iShares CDN Financial Sector Index Fund (XFN.TO) has an asset base of C$939M and the portfolio has 24 holdings. The expense ratio is 0.55%. As of the end of May this year, the ETF is up 19.78%. To put this in perspective, the financials in the US S&P; 500 Index is down 0.76% year-to-date. The S&P; 500 as a whole is up 4.34%.

Just the three large banks – Royal Bank of Canada, TD Bank and Bank of Novo Scotia – account for about 50% of the fund. The fund also contains Bank of Montreal, CIBC and a few other banks like National Bank of Canada, Canadian Western Bank and Laurentian Bank of Canada.

In addition to banks, XFN also contains a few insurers such as Great-West Lifeco , Sun Life Financial, Manulife Financial, etc.

For more info on this ETF, click here.