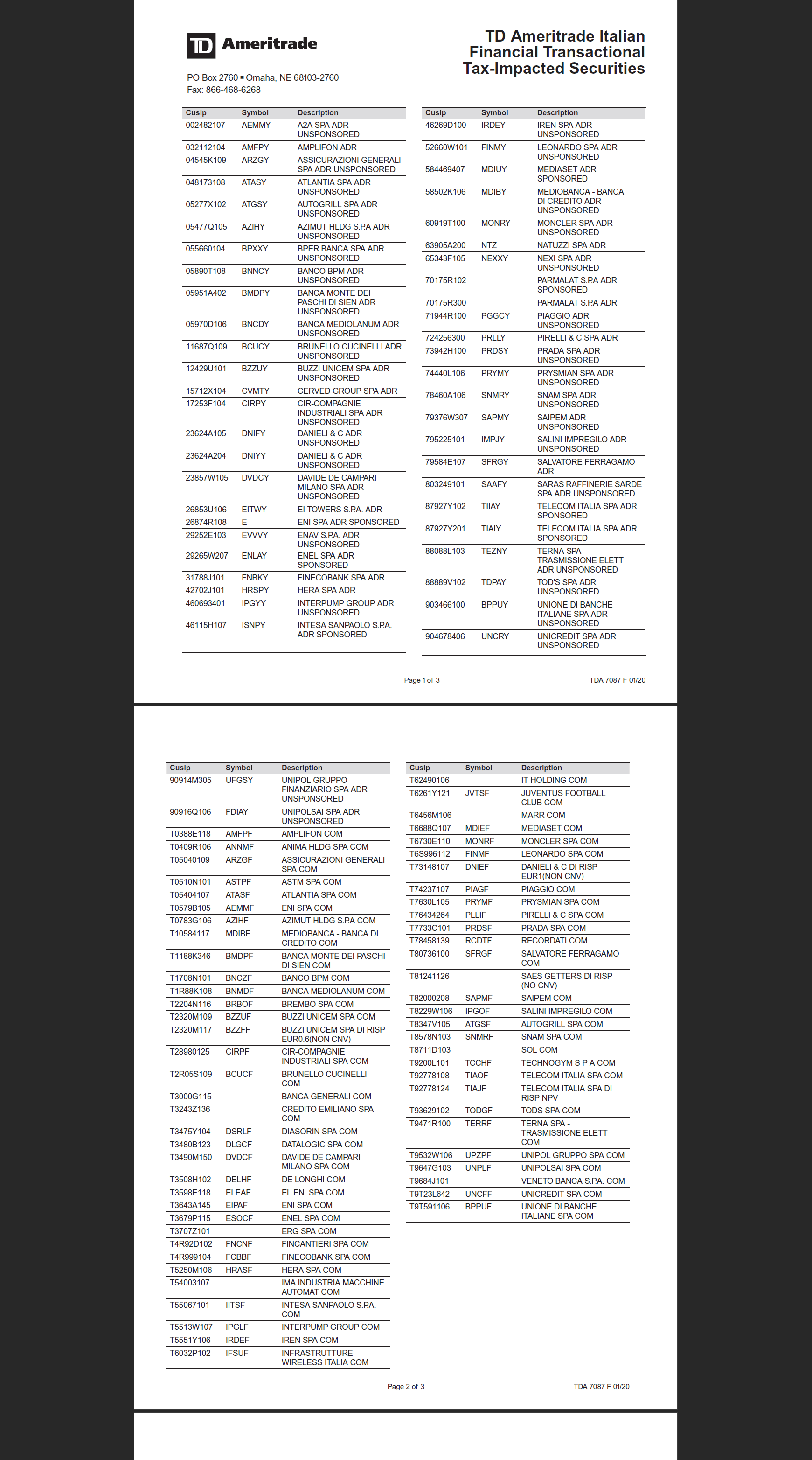

US-based investors looking to invest in Italian companies can take the ETF route as only a few companies from there are listed as ADRs.

Two ETFs that are focussed on Italy are available. One is the iShares MSCI Italy Index Fund (EWI) and the other is the NETSâ„¢ S&P;/MIB Index Fund Italy (ITL).No closed-end funds exist for Italy.

1. iShares MSCI Italy Index Fund (EWI)

EWI has 38 stocks with financials accounting for about 45% of the portfolio. In the current economic situation this high allocation to financials is not smart. Energy takes up 25% of the holdings with Eni Spa (E) the top holding in the ETF.

Total assets in this ETF is $104 M and the expense ratio is 0.52%. The dividend yield (30-day SEC yield) is 9.86%.

EWI was down 48.93% tracking the meltdown in global markets last year.

2. NETSâ„¢ S&P;/MIB Index Italy Fund (ITL)

ITL was launched by Northern Trust who was one of the late entrants to the world of ETF last May.

NETS ETF Description:

“The S&P;/MIB Index (Italy), developed by Standard & Poor’s and Borsa Italiana, is the primary benchmark index for the Italian equity markets. The index captures approximately 80% of the domestic market capitalization and is comprised of highly liquid, leading companies across leading sectors in Italy. The S&P;/MIB measures the performance of 40 equities in Italy and seeks to replicate the broad sector weights of the Italian stock market. The index is market capitalization-weighted after adjusting constituents for free float.”

The ETF has assets of just $1.1 M and the expense ratio is 0.47%. ENI Spa is the top holding here as well. ITL contains more financial stocks than EWI at nearly 48% of the total holdings. Last year ITL was down 46.24%. This ETF has a very tiny asset base and so better to avoid it.