On August 28, I wrote an article on the Top Canadian Dividend stocks available in the USA as interlisted stocks.Today’s post is an update to that article.

On August 28, I wrote an article on the Top Canadian Dividend stocks available in the USA as interlisted stocks.Today’s post is an update to that article.

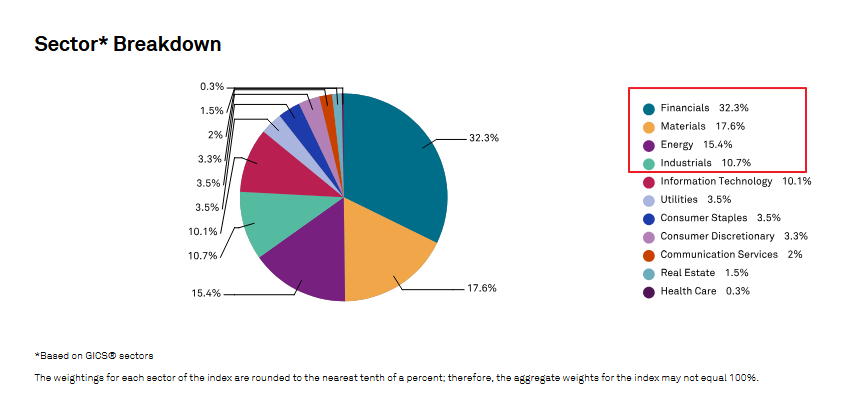

Out of the 37 stocks in the S&P; TSX Canadian Dividend Aristocrats Index, there are 11 stocks that are traded in the New York Stock Exchange. The following table and chart lists these stocks with their current yields:

[TABLE=9]

Analysis:Out of the five large banks in Canada, four made it to this list. All the four banks have yields of above 6% with BMO having the highest yield at 10.93%. So far, all four haven’t announced any cuts in dividend rates. However on Nov 18, ScotiaBank announced a writedown of $595 million after tax related to “relating to certain trading activities and valuation adjustments.”. TD has announced that it will have a “trading losses of approximately C$350 million leading to a net loss in its wholesale banking division.”

Fourth Quarter Results – Announcement Dates:

RY – December 5

TD – December 4

BMO – November 25

BNS – December 2

Sun Life Financial Services Canada and Manulife are both insurers. MFC is a good long-term play.Brookfield Properties Corp is a real-estate operator, not a favorite sector now. CNI, CNQ, ENB and IMO all have low dividend yields. They are included in this Aristocrats Index because they have increased dividends in the past 7 years though the dividend rate is still low.

The above 11 stocks had lower yields back in August. As the market has crashed in the following months their yields have risen to current levels. For an investor looking to invest in Canada, these stocks might be good picks to research further.Please bear in mind that dividend payments are not guaranteed and may be cut or suspended at any time.