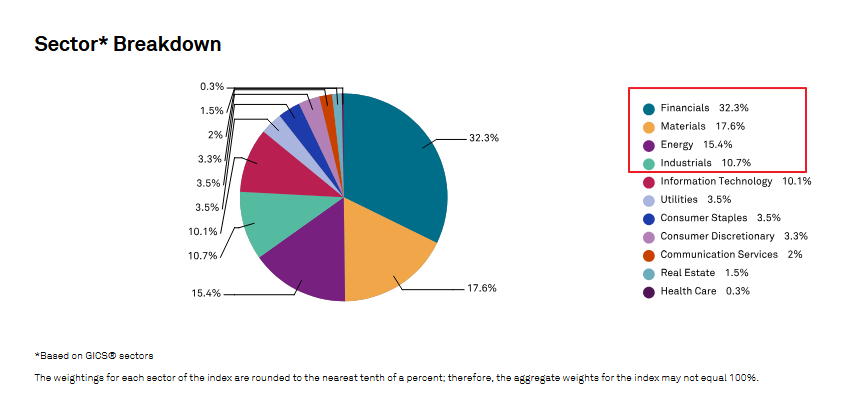

Canada is blessed with many natural resources. Canada exports most of these resources to other countries including the US which is its largest trading partner. Some of the natural resources are timber, minerals like gold, uranium, crude oil(from tar sand), etc.Since Canada is heavily dependent on commodities we can say that the Canadian economy is a commodity-based economy. Unlike commodity driven economies like those of Russia, Brazil, etc. Canada has a stable political system, western style democracy, closer to the US, etc.

Recently as the price of crude oil rose recently Canadian tar sands became even more valuable. In addition to Calgary, Alberta the demand for Canadian crude has create a few boom towns like Fort McMurray in Northern Alberta. Sure that the price of oil is falling for the past few days. But I believe that this is only temporary. In the next few months it may start to back up again. An investor looking to add some stocks from the energy sector can look into the Canadian energy sector stocks listed below. All these stocks trade as interlisted stocks in New York.

1. Company Name: Encana

Ticker: ECA

P/E : 16.52

Dividend Yield : 2.25%

2. Company Name: Suncor Energy Inc

Ticker: SU

P/E : 16.46

Dividend Yield : 0.36%

3. Company Name: Canadian Natural Resources Ltd

Ticker: CNQ

P/E : 25.90

Dividend Yield : 0.44%

4. Company Name: Imperial Oil Ltd

Ticker: IMO

P/E : 13.04

Dividend Yield : 0.79%

5. Company Name: Petro-Canada

Ticker: PCZ

P/E : 5.57

Dividend Yield : 1.82%

6. Company Name: Talisman Energy Inc

Ticker: TLM

P/E : 14.03

Dividend Yield : 1.14%

7. Company Name: Nexen Inc

Ticker: NXY

P/E : 11.25

Dividend Yield : 0.65%

In addition, there are other energy stocks like Husky Energy Inc but they trade on the OTC exchange. For those of you who have access to the Toronto Stock Exchange, a better pick to gain exposure to the Canadian energy sector would be the ishares Canadian Energy Sector Index ETF with ticker XEG.TO.