The developed markets are in the bear’s grip for many months now due to the credit crunch. Investors looking for better returns went to emerging markets like Brazil,India, China, etc. last year and even early this year.But that strategy is not working anymore since the emerging markets have plunged as well.My friend Vlad highlights some of the emerging market indices in the article titled Emerging markets indexes.

So this year investors are going to unusual places to invest. These are countries like Vietnam, Egypt,Peru,Indonesia,Romania, etc. Together these extremely risky markets are called “Frontier markets”. Already this year, ETF providers have luanched many ETFs for the frontier market countries.

In this post, lets look at a few ADRs,funds to invest in the frontier markets:

1.Credicorp Ltd. (BAP)

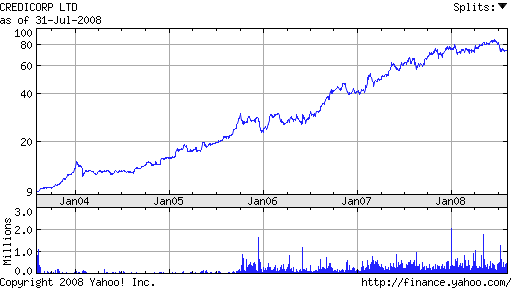

Credit Corp is a banking company in Peru.The stock has had an incredible year run as the chart shows below.BAP has a PE of 13.05 and a dividend yield of 2.10%. Beta is 1.1.The average annual dividend growth for the past 5 years is 45.41%.

Chart: 5 Year Growth

2.Indonesia Fund (IF)

IF is a closed-end fund now trading at a discount of -11.24%.This a small fund with assets of just $106M.

3.Thai Capital Fund (TF)

TF is a closed-end fund now trading at a discount of -9.93%. This a small fund with assets of just $41M.TF is down YTD some 26%.

4.Turkish Investment Fund (TKF)

This CEF has an asset base of about $111M and it is down some 26% YTD.

5.Philippines Long Distance Telephone Co (PHI)

Telecom company in the Philippines.with a high dividend yield of 5.14%.

Again the above investment vehicles should be carefully evaluated before adding them to a well diversified portfolio.

Hi Kevin,

Thank you for mentioning my post about emerging market indexes. Your blog is really very good source of information about international companies and funds listed on US exchanges. Which makes attractive to wide investor’s community.

I have to say that your site is unique in blogosphere. I wish you a lot of success and keep up good blogging

Best Regards

Vlada

Hi David…

I added u to my blogroll. good focus blog. Make sure you come and check me out over at iBankCoin throughout the week…

http://ibankcoin.com/gioblog/

-gio

Hi Vlada

Thanks for your comment and kind words. Yes my blog is kinda unique and I a trying to improve it as much as possible for my readers.

-David

Hi Gio

Thanks.I am adding you in my blogroll now.

Looks like there are 5-6 frontier markets etfs that now trade. I found this site seems to note them all. http://www.frontiermarketsetf.com Good to see about the the ADRs though. But I would think we would want an ETF, rather than indiviudal stocks as less riskier. Thoughts?

John

Yes there are a few frontier market ETFs now.But that number will grow as more providers join the party.That site seems to be in its early stages of growth.

Yes an ETF is the best way for an investor entering these markets as the risks in individual stocks are tremendous.I mentioned BAP as that seems to be an exception and seems to be great company in Peru.Again like I mentioned in the post, one must thoroughly analyze such stocks.It may be a good idea to add individual stocks by an investor who is already in such markets.Usually these are wealthy investors who have long invested in obscure markets since they can invest in those countries directly instead of waiting for funds to introduce these to all of us like its happening now.

So in summary I would advise adding ETFs knowing that they are risky as well but less riskier than select picks.Even if one stock in the fund holding of say 3% crashes the fund might not be adversely affected.Hope this helps.

Just as you rightly said, these emerging markets are very risky. Take the Nigerian stock market for example, it was among the fastest emerging markets in the world, as of last year, this market is a regulated market and investors really made some good money last year, up to 3000% in some stocks, but this year has been termed the worst in the history of the nations stock market. All the gains has been eroded, though, there is a hope of rebound. Investment is risk actually.

Eze

Thanks for the comment.Yes these emerging markets have become “submerging markets” (latest Business Week used this name). I haven’t followed the Nigerian Market but sounds interesting. I will check it out. Similarly markets in the Middle Eastern countries are also extremely risky. Most of the companies and stocks are owned by a few wealthy people and they determine what happens.

-David