There are 5 large private banks in Brazil.Out of these, three trade as Depository Receipts (DRs) in the US. They are:

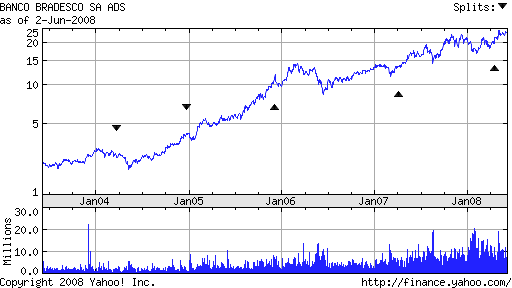

1. Banco Bradesco S.A (BBD)

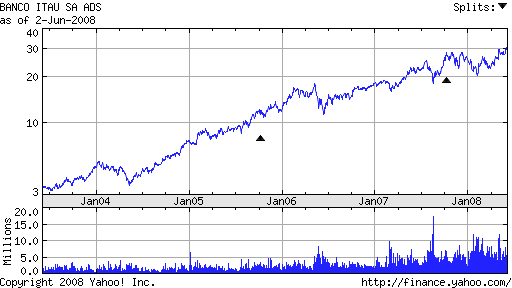

2. Banco Itau Holding Financeira S.A. (ITUB)

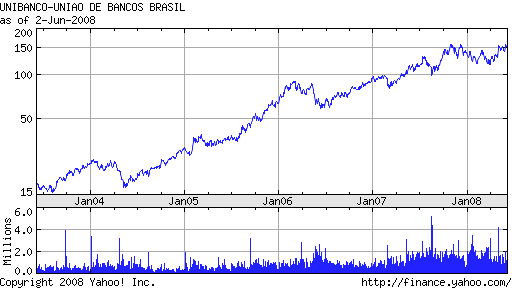

3. Uniao de Bancos Brasileiros S.A. (UBB)

Profile and Key Points (All data as of June 2,2008)

1. BBD:

Bradesco Bank is the largest private sector bank in Brazil with more than 2900 branches.

BBD has yield of 0.82%.It pays monthly dividends.P/E ratio is 17.54 and the 5-year Earnings Growth is 19.57%. BBD has a high payout ratio.In 2007, it paid out 37.10%

of Net Income.BBD stock split 3:2 last month.

A $10,000 investment 5 years ago would be worth $130,100 as of May 31,2008 (Source: S&P Quantitative Stock Report).

5-Year Chart:

2. ITU:

Itau Bank is the second largest private bank in Brazil with Head Quarters in Sao Paulo and 50,000 employees.

ITU has yield of 1.79%.Just like BBD, it also pays monthly dividends.The 5-year Earnings Growth is 24.87%.The 12-month Trailing P/E is 15.8.

A $10,000 investment 5 years ago would be worth $107,366 as of May 30,2008 (Source: S&P Quantitative Stock Report).

5-Year Chart:

3.UBB:

Unibanco is the 3rd largest private bank in Brazil with Head Quarters in Sao Paulo.

UBB’s dividend yield is 2.72%.Beta is 2.1. The 5-year Earnings Growth is 24.87%.The 12-month Trailing P/E is 23.1.

A $10,000 investment 5 years ago would be worth $110,484 as of May 30,2008 (Source: S&P Quantitative Stock Report).

*** On May 29 Unibanco announced that it proposed to split its stock in the ratio of 5:1 and also issue a 10% stock bonus. ***

5-Year Chart

Sources:

http://www.bradesco.com.br/ri/eng/

http://ww13.itau.com.br

http://www.ri.unibanco.com.br/ing/hom/index.asp