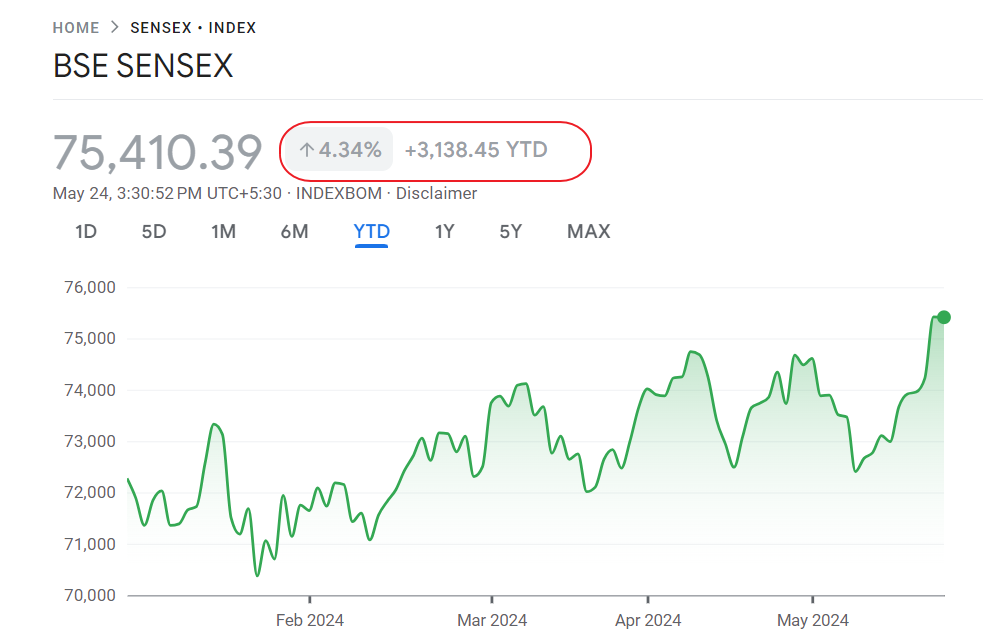

The stock market in India crashed recently. The market called the BSE Sensex (Bombay Stock Exchange) crashed from an all-time high of 21206 to 18,242 on Friday. On Jan 22nd, it fell 9.75% nearly 2000 points at the open. The market was halted for an hour and then reopened to recover some 700 points.

Link on Sensex:

http://finance.yahoo.com/q/bc?s=%5EBSESN&t;=1y&l;=on&z;=m&q;=l&c;=

After making investors happy with returns of 40%,50% in the past few years, the Sensex is now returning back to “normal” levels. The P/E ratio of the Sensex is the highest among emerging markets and the yield is less than 1%. This is pretty low when compared with yields of over 3% in Thailand, Singapore and other Asian countries.

There are many Indian stocks trading as ADRs in the US. A few of them are listed below. As mentioned above due to high volatility and sky high P/E ratios, these stocks may “fluctuate” a lot.So invest after doing some detailed due diligence and tread carefully venturing into the Indian markets.

Indian ADR stocks (IT and other stocks excluded):

1. Dr Reddy’s Laboratories – Pharma – RDY

2. HDFC Bank – Banking – HDB

3. ICICI Bank – Banking – IBN

4. Sterlite Industries – Metals – STI

5. Tata Motors – Cars – TTM