While the US markets are in the dumps for many months now due to the sub-prime mess, the stock markets of China and India are on fire. Last year the Shanghai market doubled and the index in the Bombay Stock Exchange increased by over 45%.

Before you jump with both feet into these red hot markets, read this post first.

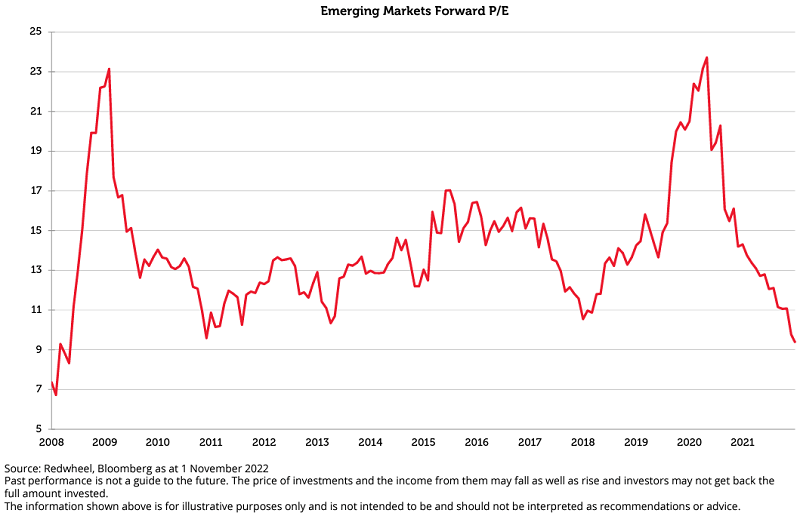

The markets in these two countries are a bubble waiting to burst at any time. Both countries are experiencing heavy Foreign Direct Investments (FDI) which is fueling all kinds of hype – ranging from infrastructure construction to real estate investments. The P/E ratios of stocks in these countries are now multiple times that of the developed markets. While their economies have had awesome growth over the past few years, it may not continue to grow at the same rate in the future.

A key factor that is often overlooked when evaluating emerging market stocks is the role of the government in those countries – especially the role the governments play in creating bubbles in the market. In China and India, the governments participate in the bubble development process by listing the shares the government held companies in the stock market and reaping huge profits. You may ask how do they do this?

This is how they create these bubble companies. The governments own the majority of the shares in a state-owned company and they list the company with only a portion of the shares floated among the public investors. For example – the government may keep 98% of the shares in a company and flat the remaining 2% in the markets. Since only 2% of the shares are available these stocks go up to sky-high levels due to limited liquidity in the market and heavy demand. Lets look at an example of this scenario in China and India.

1. India – National Mineral Development Corporation – NMDC Ltd.

This is a state-owned miner. The government of India listed this company by floating only 1.62% of the available shares. The remaining 98.38% is still owned by the state. With only 1.62% of the shares in float among the retail investors, institutional and foreign investors the stock was manipulators dream. Less than 5000 shares were traded daily and the stock went up almost 2000 points every day for almost a month. Now this company is the 19th largest listed company in India. This is a classic case of how to create a bubble stock.

2. China – PetroChina

This is another state-owned outfit in the communist country of China. When the Chinese government listed this on the Shanghai Exchange back in November last year, the shares doubled on the listing day and the company become the first ever “Trillion” $ company in thw whole world easily passing even Exxon-Mobil.

The government listed this as an A-share class. This means only the local people can invest in them.Foreigners are not allowed to own them. They floated only 2.5% of the total shares in the company. The remaining 97.5% are owned by the government. Since so little shares were available for the locals there was huge imbalance in supply and demand. Locals went crazy for this stock pushing the price higher almost immediately when it got listed.

Now a Chinese source says that the government is waiting to unload billions of Petro China’s shares at the right price and stands to make billions. Thankfully it will unloaded onto the locals and not us.

Incidentally the last time I heard about a “trillion” $ company in the making was during the dot com bubble days. At that time, a CEO of a dot con company called Infospace (INSP) came on CNBC and made a comment to the effect that his company would be the first Trillion $ company in the world. We know what happened to the dot com bubble and this INSP went to a few cents a share. Nobody knows what happened to the CEO clown who made the “bold” statement

The latest edition of Forbes Richest persons on this earth did not list this clown as the one and only “Trillionaire”.:-)

The two examples posted above are just samples of state-owned listed companies. There are many more such companies that are now some of the hottest stocks in these countries.

Comments on this article are welcome.