Frontier Markets represent countries that are one step below than emerging markets and are the riskiest. These markets include countries such as Morocco. Pakistan, Vietnam, Argentina, etc. The MSCI Frontier Markets Index gives exposure to 30 countries.

A recent post by Carlos Hardenberg at Franklin Templeton Investments discussed some of the myths around the frontier markets. According to him, these equity markets are undervalued based on P/E ratio relative to emerging and developed markets. From the article:

Attractive Valuations with Limited Correlation

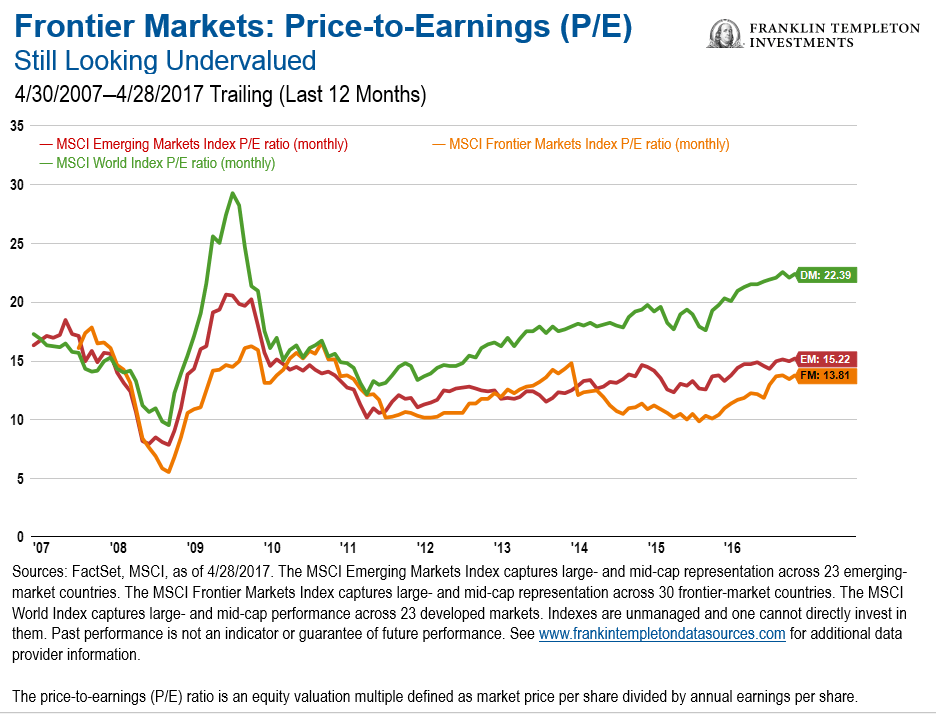

When we talk about the attractiveness of frontier-market investing, the single most important factor for many investors tends to be valuations.

Currently, frontier market equities are trading at what we consider very cheap valuations compared with both developed and emerging market peers, as the first chart below shows.

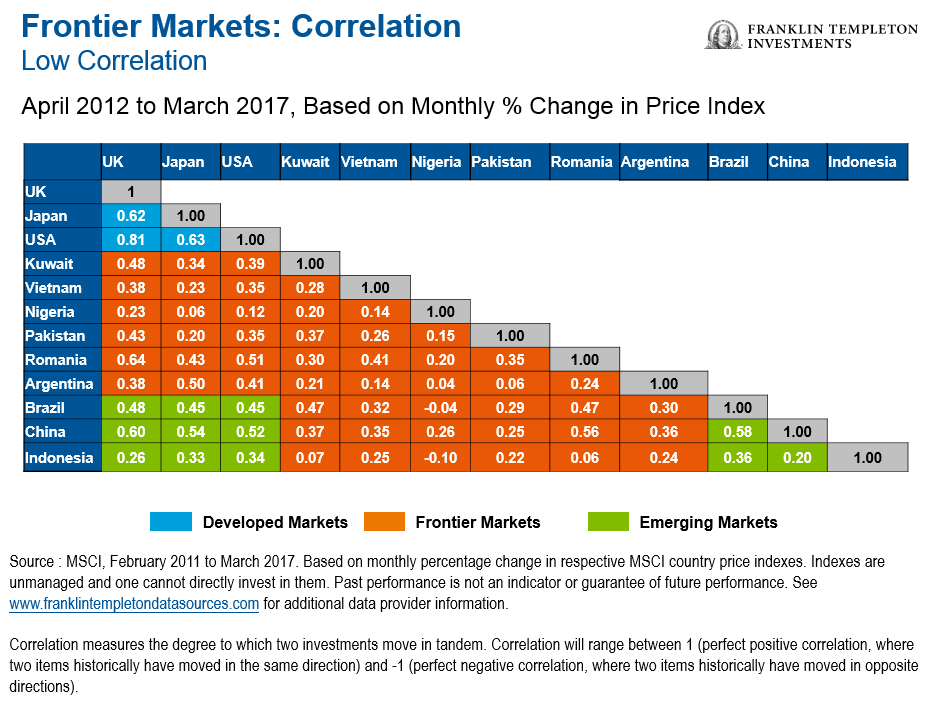

At the same time, as an asset class frontier markets have traditionally had very little correlation1 with emerging markets such as China, Brazil or Indonesia, or with developed markets including the United States, Japan or the United Kingdom.

Click to enlarge

1. Correlation measures the degree to which two investments move in tandem. Correlation will range between 1 (perfect positive correlation, where two items historically have moved in the same direction) and -1 (perfect negative correlation, where two items historically have moved in opposite directions).

Source: Busting the Frontier-Market Myths, Franklin Templeton, June 1, 2017

Here are a few points to consider before jumping into frontier markets:

- Since frontier countries are the most riskiest, investing in these markets are not suitable for every retail investor.

- Even those who want to invest in them should limit their allocation to a tiny portion of their portfolio.

- The MSCI benchmark index has a dividend yield of 3.93% compared to just 2.41% for the MSCI World Index.

- Liquidity is a major issue in frontier markets since they are very tiny compared to developed markets. So in times of declining markets it may be difficult to get out.

- These countries are plagued by governance issues, transparency issues, political stability, corruption and other social ills.

Related ETFs:

Disclosure: No positions

Also checkout: 2020 vision: the changing face of frontier markets, Money Observer