European stocks are back in favor among global investors. Though European stocks have let down investors in the past few years the tide seems to be turning for the better with the overall economy picking up speed and many of the political and fiscal crises ending. Fellow blogger and financial advisor Josh Brown at Ritholtz Wealth Management posted the below excerpt from a research report produced by his firm:

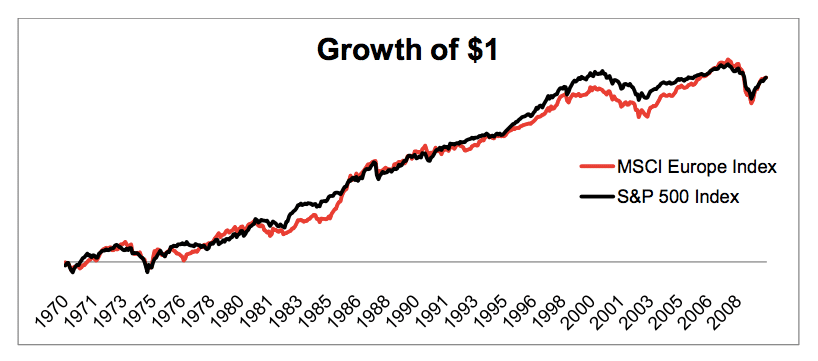

U.S. investors could look at past performance, even long-term performance, and conclude that there is no point investing in European equities. One dollar invested in MSCI Europe (USD) in 1970 is now worth $56. One dollar in the S&P 500 over the same period would have grown to $106 today. Yet on closer examination, this is a perfect example of statistics reporting the facts but hiding the truth. Thanks to the power of compounding, performance over the last few years has had a huge effect on long-term returns. From 1970 to 2009, the S&P 500 compounded at 9.87%, and MSCI Europe at 9.88%. The entire outperformance of the last 47 years occurred during the last seven years.

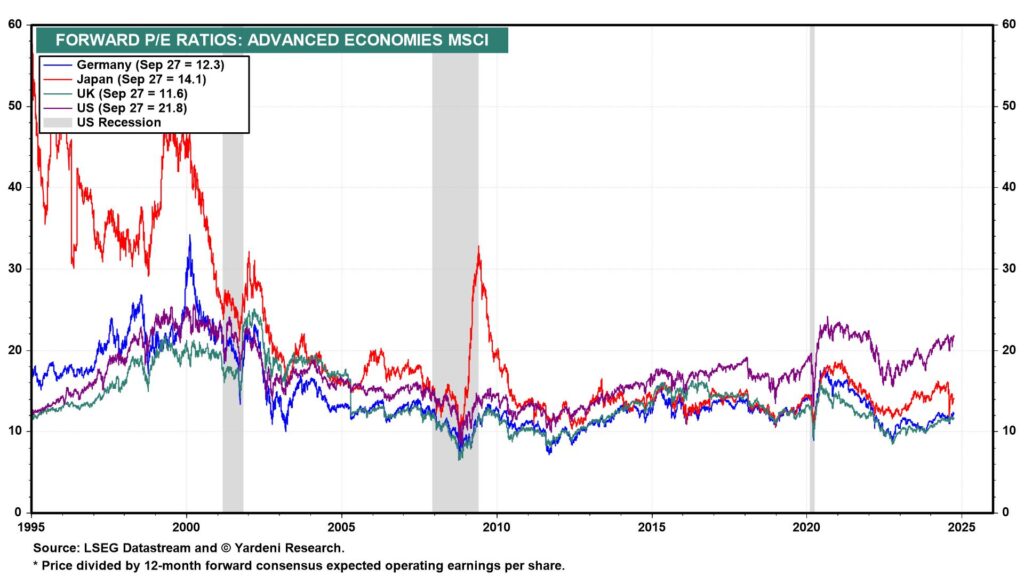

That underperformance, combined with investors’ attitudes toward European stocks — which are apathetic at best — has caused the valuation gap between U.S. and European equities to widen into a gulf. The cyclically adjusted price-to-earnings ratio, or CAPE, measures the price to real earnings over the last ten years. The ratio for the United States is 30 and for European equities it’s just 17.

Source: What We’re Telling Clients About European Stocks, The Reformed Broker, May 24, 2017

The above research is fascinating indeed. Josh noted in the above article American stocks were also flat the 200-2009 when the S&P 500 went nowhere (excluding dividends). This decade came to be known as the “lost decade” for US stocks.

Josh posted a followup article yesterday on the ETFs to gain exposure to Europe.

Below is another excerpt from a recent article on European stocks by Frank Holmes at US Funds:

Europe is back on the map. That was one of the main takeaways this week from the SkyBridge Alternatives (SALT) hedge fund conference in Las Vegas, where $3 trillion in assets was represented. Speaker after speaker touted European equities for their attractive valuations and as a means to diversify away from the volatile American market in light of rising U.S. geopolitical risk. France’s election of centrist Emmanuel Macron over far-right nationalist Marine Le Pen this month has especially eased investors’ fears that antiestablishment forces would challenge the integrity of the European Union (EU).

Economic growth is finally picking up in Europe—“solid and broad,” as European Central Bank (ECB) president Mario Draghi recently put it—and many countries’ purchasing managers’ indexes (PMIs) are at five- and six-year highs. Export orders and hiring have accelerated. Labor participation is improving. European commodity sectors, including energy and metals, look cheap and oversold, meaning it might be time to start accumulating.

Trading at around 17 times earnings, European companies are priced to move compared to American firms, which are trading at 22 times earnings.

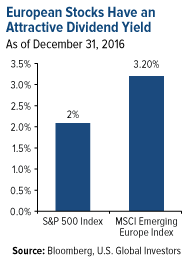

Dividend yields also look attractive relative to U.S. stocks. The MSCI Emerging Europe Index, which is most heavily weighted in Russian, Polish and Turkish stocks, currently yields 3.2 percent. The S&P 500 Index, by comparison, yields 2 percent.

A recent Barron’s article, “Europe on Sale: Time to Buy Foreign Stocks,” makes the same bullish case as many of the SALT presenters. Its author, Vito J. Racanelli, suggests that the eight-year bull run in the U.S. could be coming to an end, and that the baton is being passed to Europe. Overseas markets have already attracted more fund flows so far this year than the U.S. market, with a whopping $6.1 billion being plowed into European equity funds in the week ended May 10.

“Given attractive valuations, diminished political risk, low interest rates and a pickup in global growth, international markets, and Europe in particular, could finally start to outperform,” Racanelli writes.

Source: Hedge Fund Managers Pour SALT on U.S. Stocks, Look to Europe By Frank Holmes CEO and Chief Investment Officer, U.S. Global Investors

To answer my title question, the answer is Yes but investors have to be selective. Since many stocks and funds have already shot up this year it may be a good idea to add them in a phased manner and not jump in all at once. For instance, one of the top ETFs for Europe is the SPDR Euro Stoxx 50 ETF (FEZ) which gives exposure to the 50 largest firms in the Eurozone countries (excluding UK, Switzerland and others where Euro is not the official currency) is up 17.93% year-to-date.

For most investors going with an ETF is the best option to add European stocks to their portfolios. However investors willing to buy individual stocks have plenty of options available as many of the large caps trade on the US market as ADRs. The following are a few factors that these investors must consider:

- Dividend withholding tax can take a big bite of dividends to US investors. For example, Switzerland charges the highest rate in Europe.

- The UK does not deduct the dividend withholding tax (excluding REITs) for US investors.

- Many of the large Spanish banks such as Banco Santander SA (SAN)and, Banco Bilbao Vizcaya Argentaria(BBVA) have high exposure to Latin America. So should Latin economies perform well these bank stocks can go even higher.

- Germany is an export-based economy. So companies in the export heavy sectors such as industrials, autos and chemicals are good bets. Siemens (SIEGY) and BASF (BASFY) are two options.

- French stocks have given back some of their gains after the election of Emmanuel Macron as President. But his pro-growth policies should give a boost to the economy and French stocks could continue their upward momentum.

Disclosure: Long SAN and BBV