The counting is underway on the Brexit vote. Global markets have already rallied this week on the hope that voters would support the “Remain” group than the “Leave” group. While we wait for the results let’s take a look at how the UK equity market reacts after major one-day declines.

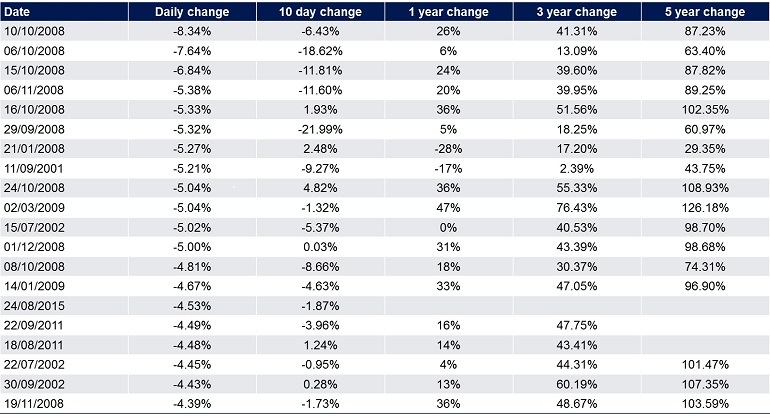

According to a report by Schroders, based on analysis of 25 years of data, stocks have returned positive returns over the subsequent 1, 3 and 5-year periods most of the time as the table shows below:

Click to enlarge

The Biggest one-day declines of the FTSE All-Share Index in the past 25 years and subsequent returns:

Data Source: Financial Express, Schroders , June 2016

Source: 25 years of the UK stockmarket: what happens after the biggest one-day falls?, Schroders

In October 2008, the market as measured by the above index fell 8.3%. But one year later the index returned 26% including dividends. The total returns after 3 and 5 years were 41% and 87% respectively.

So even though the one day loss was huge, investors that held on to stocks and rode the volatile periods were richly rewarded after a few years. The returns assume that investors held the stocks before the large day plunge. For investors that bought stocks right on the day, the returns noted would be much higher. But picking the bottom is next to impossible for most investors.

Another important point to remember is that “time in the market is critical than timing the market”. This is because predicting the future is not possible and no one know when markets would sky rocket one day and when it would plunge hard one day.So for almost all investors the best strategy is to simply stay put. Here is an interesting example quoted by Schroders:

Consider this example. If you had invested in a basket of equities investments in global stockmarkets – the MSCI World index – between 2005 and 2015 you would have received a return of 60%.

But if you missed the 10 best days within that period then you would have lost 5%, according to Financial Express data compiled by Schroders. It’s an extreme example but demonstrates the risks of trying to time markets.

In summary, the following are some key strategies to remember for success in equity investing:

- Timing the market is a fool’s game and is a sure recipe for disaster.

- Keeping calm and not taking emotion-driven actions during market meltdowns is crucial.

- Holding a diversified portfolio of assets is wiser than putting all eggs into one basket or making speculative bets.

- Keeping investment fees low will help generate higher returns especially over many years. So high expense ratio funds should be avoided at all cost.

- When there is blood on the street, try to add high-quality dividend paying companies to boost returns.

- Ignore IPOs.Most IPOs are good only to founders, early investors, underwriting firms, etc.

Related ETF:

- iShares MSCI United Kingdom Index ETF(EWU)

Disclosure: No Positions

Update:

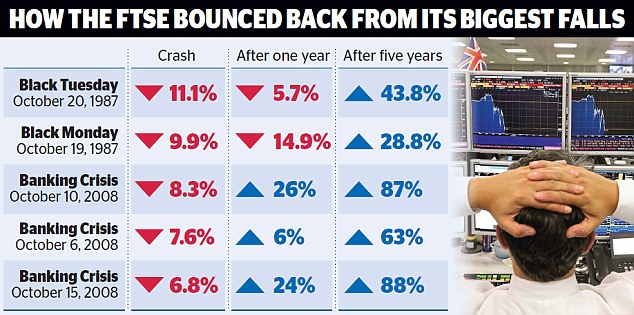

Click to enlarge

Source: Stocks that will soar from Brexit: Don’t panic! Keep calm and use market turmoil as an opportunity, This is Money