For the Fiscal Year 2012, the total U.S. Federal Spending was about $3.8 Trillion and the Tax Revenue was about $2.5 Trillion resulting in a deficit of about $1.3 Trillion. For many years now, the U.S. has been running deficits as revenues were lower than expenditures. In fact, expenditures have been soaring due to rising medicare costs and other programs but revenues have barely moved up in pace.

From January 1, 2013 thirteen tax increases went into effect as part of the deal struck between the Obama administration and Congress according to The Heritage Foundation. These include the social security tax component of payroll taxes rising to 6.2% from 4.2% for all Americans, top marginal tax rate jumping to 39.6% from 35.0%, taxes on capital gains and dividends rising from 15 to 20% for taxable incomes over $450,000 for joint filers, a 3.8% surcharge on investment income for taxpayers with taxable income of over $250,000 for married filers, etc.

Though all these tax increases seem high and thousands of hours were wasted by politicians debating the issues as part of the Fiscal Cliff negotiations late last year, they are actually lower compared to taxes paid by citizens of other G-7 countries.

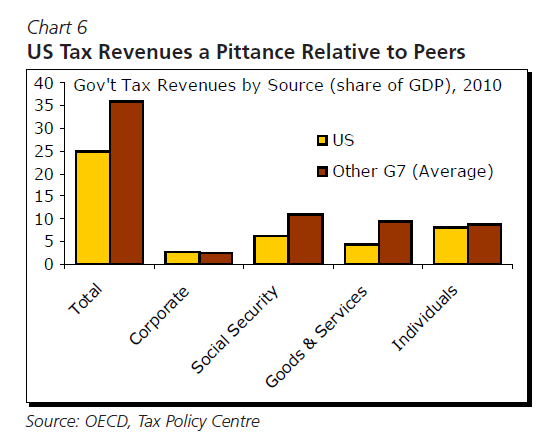

The following chart shows the U.S. government taxes by revenue source as a measure of GDP in 2010 relative to other G-7 countries:

Click to enlarge

Source: US in Debtors’ Prison: A Life Sentence? by Emanuella Enenajor and Andrew Grantham, Economic Insights, January 29, 2013, CIBC World Markets

The total U.S. tax revenue was at at least 10% lower than the average of other G-7 countries. Except corporate taxes, the U.S. collected lower taxes in the other sources noted above compared to other G-7 countries.

According to the CIBC research report, Japan plans to implement a new sales tax in the years ahead to increase tax revenues. However in the U.S. sales taxes on goods and services are controlled and collected by the individual states and no national sales tax such as Value Added Tax(VAT) exists in the country. In fact, the U.S. is the only developed country which does not have a national-level sales tax. As a result of this archaic tax system, each state behaves like a separate country constantly manipulating the tax rates mostly to finance all types of local boondoggles such as tax subsidies for casinos, stadiums, construction of parking garages, park renovations, etc.