The S&P 500 is up 12.8% year-to-date(YTD). Compared to the performance of the US equity market, Latin America markets have been mixed so far this year. For example, Brazil’s Bovespa is up 3.1%, Chile’s Santiago IPSA is off 14.5% and Mexico’s IPC All-Share is up 15.4%.

Traditionally the U.S. has long considered Latin America as its own “backyard”. For more than a decade most of the Latin American nations have aligned themselves politically with the U.S. The U.S. intervened and installed friendly regimes in some countries when they tried to resist free-market principles.

From a recent article in The Wall Street Journal:

Latin America is becoming a tale of two economies, with nations like Peru, Colombia, Mexico and Chile growing faster than the global average and nations like Argentina and Brazil struggling with crippling slowdowns.

Brazil, for much of the past decade a growth powerhouse in the region, reported on Friday that its economy grew at an annual clip of just 2.4% in the third quarter from the previous quarter, far less than expected and dashing hopes of a bounce-back fueled by hefty interest-rate cuts and tax breaks.

The result suggests Brazil’s growth for the full year is likely to be 1%, according to São Paulo-based Tendencias consulting group—a far cry from the government’s expectations of 4.5% this year.

Overall, resource-rich Latin America has done very well in the past decade, mostly thanks to China’s ravenous appetite for raw materials to fuel its rise, which drove up prices for everything from oil to soybeans.

But the global slowdown of the past two years has created a divide in the region between countries that pushed a more aggressive free-market agenda and kept a tighter grip on the public purse and those that used the swell in coffers from rising commodity prices to embrace a bigger role for government in the economy.

U.S. investors should consider investing in Latin American stocks to generate better returns.

We all know the ubiquitous disclaimers found on fund documents that state “Past Performance is not an Indicator of Future Results”. While this is true, past performance is still an important measure and an indicator of future results at the country level since countries that performed well in the past generally perform well in the future and vice versa. Countries do not change dramatically overnight except in very rare circumstances such as the changes experienced by East European nations following the fall of the Berlin Wall. Myanmar is another example when it went from a military dictatorship with a closed economy to a democracy with a free-market economy almost overnight recently.

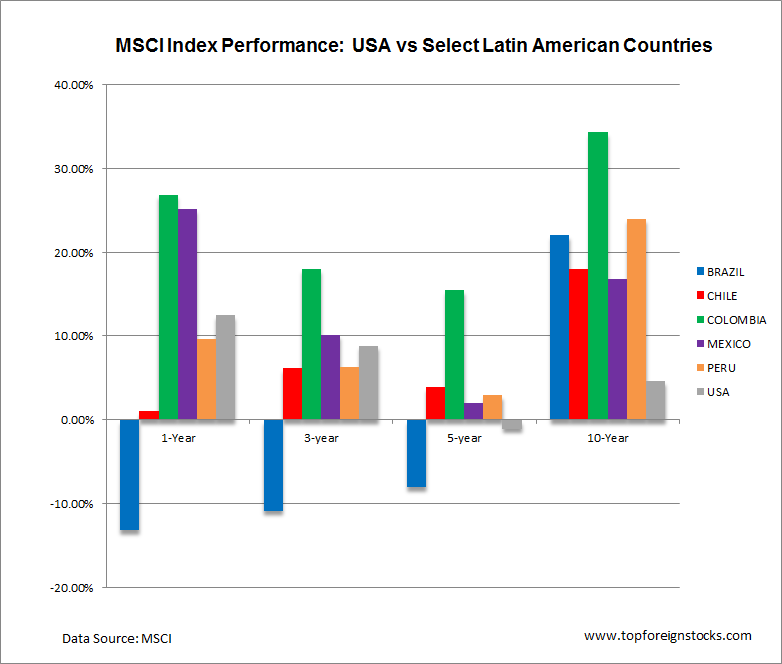

Though the U.S. is performing better this year relative to Latin American countries, in the long-run the performance of US stocks have lagged. The MSCI returns in US dollar terms for the U.S. and the five Latin American emerging economies is shown below:

Click to enlarge

Source: MSCI

Mexico had higher returns than the U.S. in all the periods shown. Colombia was the best performer easily beating the U.S by a wide margin especially in the 10-year period. The slowdown in commodity markets has hurt Brazil’s returns in the 1-year, 3-year and 5-year returns.

From a dividend yield perspective, the S&P 500’s dividend yield is currently at 2.6%. It has stayed at this level for many years now despite strong growth in corporate profits. Brazil,Chile, Colombia, Mexico and Peru on the other hand have yields of 3.8%, 3.1%, 2.4%, 1.9% and 5.1% respectively according to Financial Times market data.

Hence U.S. investors looking to diversify internationally can add equities from Latin American countries discussed above especially those from Brazil, Peru, Colombia, Mexico and Chile.

Related ETFs:

iShares MSCI Brazil Index (EWZ)

iShares MSCI All Peru Capped Index Fund (EPU)

iShares MSCI Chile Index Fund (ECH)

Global X FTSE Colombia 20 ETF (GXG)

iShares MSCI Mexico Investable Market Index (EWW)

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions