Dividend yield should be one of the important factors when selecting a stock for investment. Dividend payments come out of a company’s earnings and is usually a strong barometer of a firm’s financial health. Unlike other metrics cash dividends are not susceptible to accounting or other manipulations. Hence consistent dividend payers and growers are excellent options for investors seeking both growth and income. It is widely known that over the long-term dividend return account for a major portion of the total return of the S&P 500.

From a recent article on dividends in The Wall Street Journal:

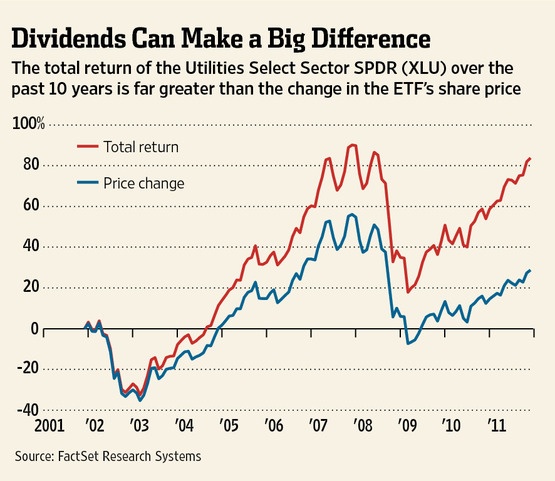

Click to enlarge

Looking solely at prices, you’d be left believing small-capitalization stocks vastly outperformed more “sluggish” utilities. Data from FactSet Research Systems show that in the decade through Nov. 30, the iShares Russell 2000 Index exchange-traded fund, which tracks the shares of smaller companies, zipped up 61%, versus a more modest 29% gain for the Utilities Select Sector SPDR.

But that woefully misrepresents the returns of these two investments. When dividends are included, the utilities ETF returned 84% to investors over the same period versus 81% for the small-stock ETF. What’s more, over the period, the value of the Utilities Select Sector fund gyrated much less violently than that of the iShares Russell 2000.

In essence: The utilities fund gave higher returns for less risk. It’s something you’d never know unless you looked at the total-return data.

Source: Price Charts Can Mislead, The Wall Street Journal

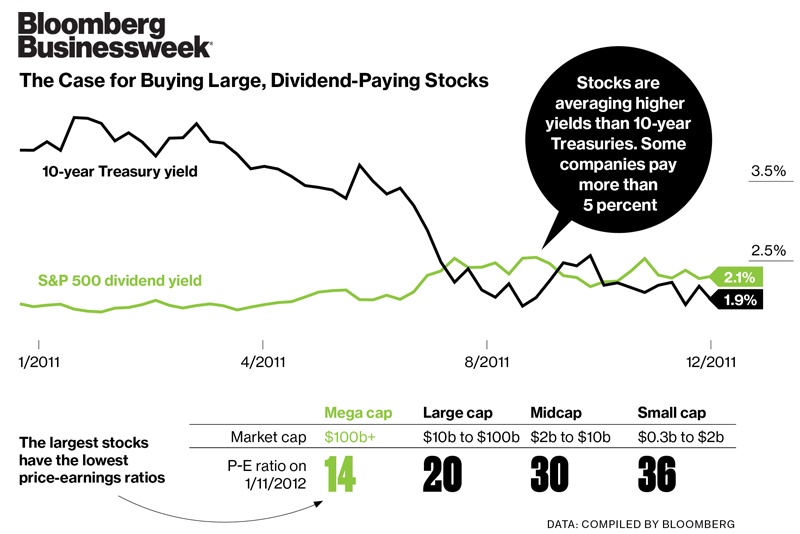

A Bloomberg BusinessWeek article also discussed about investors’ preference for dividend paying stocks in the current environment. Last year the S&P 500 was flat based on only prices. However the total return was 2.2% when dividend yield is included. The article also noted this interesting fact:

The 10 highest-yielding stocks in the Dow Jones industrial average as of Jan. 1, 2011—the so-called Dogs of the Dow—returned 17.2 percent, dividends included, over the course of the year, 15 percentage points better than the broad market’s total return.

The article went to add:

In his most recent client letter, fund manager Jeremy Grantham credited his faith in well-capitalized, cash-rich large-cap stocks for the gains in his GMO Quality Fund (GQETX), which ended the year up 12 percent. “We would normally count on winning in this strategy in a big down year,” he wrote, “but in a nearly flat year this difference is a testimonial to how risk-averse investors have been at the U.S. stock level.”

Dividends offer more than safety: With interest rates at record lows, they also are one of the few attractive sources of income. While 10-year Treasury bonds closed the year yielding less than 2 percent, the average dividend yield for stocks in Standard & Poor’s 500-stock index was 2.08 percent at yearend, and the 10 highest yielders in the Dow averaged 3.96 percent. At the top of the list, AT&T (T) yielded 5.8 percent, while No. 10 Kraft (KFT) yielded 3.1 percent. Companies in the S&P 500 will raise dividends by 11.5 percent on average this year, according to a Bloomberg Dividends forecast. “All my high-net-worth clients are looking for nothing more than a stable cash flow,” says Joshua Scheinker, a senior vice-president with brokerage Janney Montgomery Scott. “They want a high-quality portfolio with a focus on ‘income, income, income.’ I will take P&G (PG), 3M (MMM), Pepsi (PEP), AT&T, and Intel (INTC) over fixed income any day.”

Source: Why the Bluest Blue Chips Rule This Market, Bloomberg BusinessWeek

In addition to domestic dividend stocks, long-term investors may also want to hold foreign dividend stocks in their portfolios for diversification. Ten foreign dividend paying stocks that have paid dividends every year since 2001 and in some cases have grown their annual dividend payments are listed below for consideration:

1.Company: Banco Santander – Chile (SAN)

Current Dividend Yield: 4.06%

Sector: Banking

Country: Chile

2.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 4.01%

Sector: Banking

Country: Canada

3.Company:Telefonica SA (TEF)

Current Dividend Yield: 12.25%

Sector: Telecom

Country: Spain

4.Company: Enbridge Inc (ENB)

Current Dividend Yield: 3.08%

Sector: Natural Gas utility

Country: Canada

5.Company: Administradora de Fondos de Pensiones Provida SA (PVD)

Current Dividend Yield: 9.39%

Sector:Investment Services

Country: Chile

6.Company:British American Tobacco PLC (BTI)

Current Dividend Yield: 4.22%

Sector: Tobacco

Country: UK

7.Company: France Telecom S.A.(FTE)

Current Dividend Yield: 12.29%

Sector: Telecom

Country: France

8.Company: EDP Energias de Portugal SA (EDPFY)

Current Dividend Yield: 8.12%

Sector: Electric Utility

Country: Portugal

9.Company: PetroChina Company Limited (PTR)

Current Dividend Yield: 3.67%

Sector: Oil & Gas Operations

Country: China

10.Company: Empresa Nacional de Electricida (EOC)

Current Dividend Yield: 5.80%

Sector: Electric Utility

Country: Chile

Disclosure: Long RY