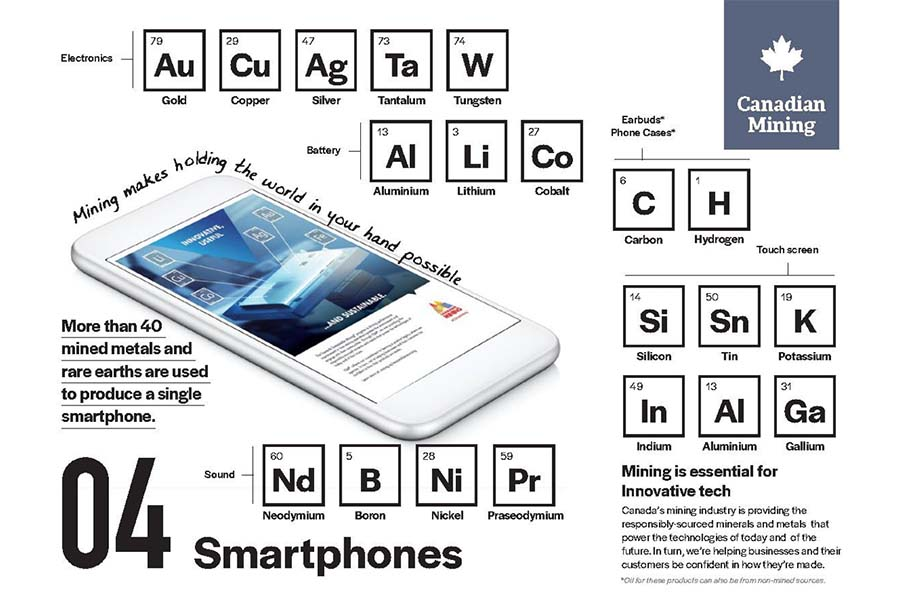

More than 40 metals and rare earths are used in the manufacture of a smart phone. The following infographic shows some of those that are present in a smart phone:

Click to enlarge

Source: Canadian Mining

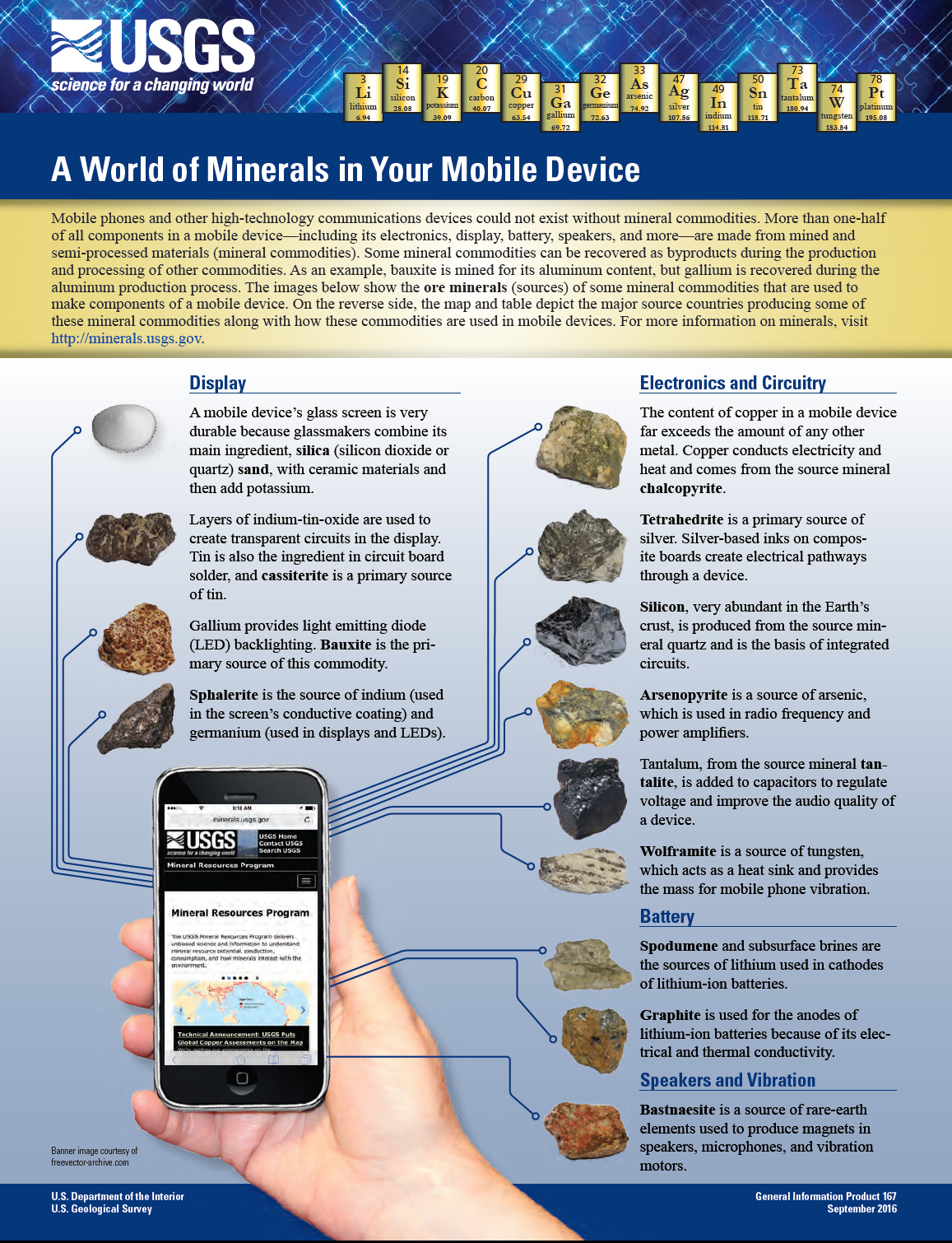

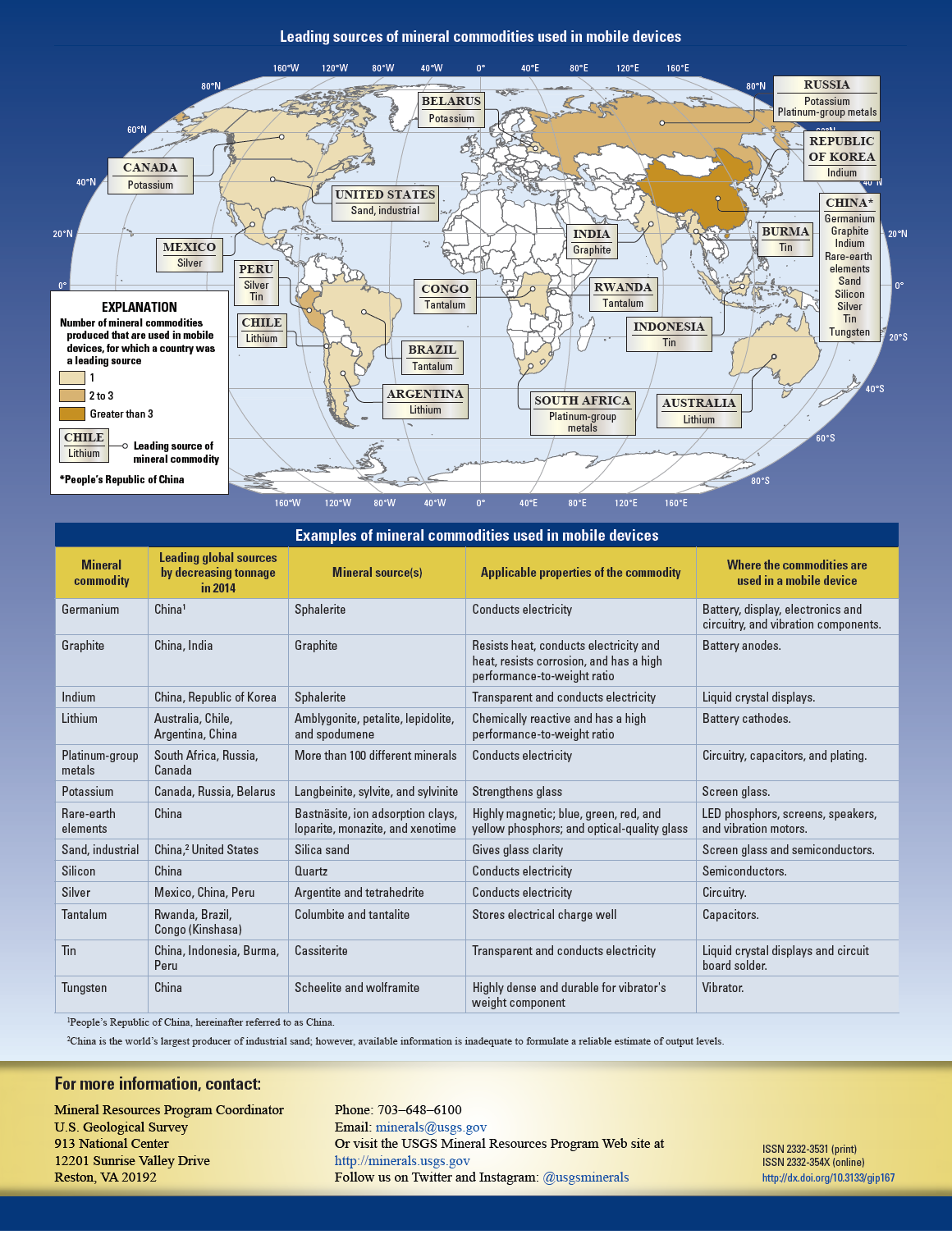

The following graphics from U.S. Geological Survey shows more details on the metals including where they are mined in the world:

Click to enlarge

Source: USGS

Related: