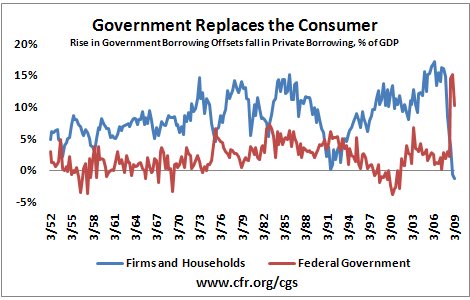

Consumers have been cutting down borrowing since the credit crunch began. However the Federal government borrowing has been growing at a staggering rate recently as the chart from CFR’s Brad Setser’s blog shows below.

Source: Council on Foreign Relations

Checkout also More on the fall in private borrowing and the rise in the fiscal defict.