The U.S. celebrates Labor Day on the first Monday of September(today) while for the rest of the world Labor Day is on May 1st. Labor Day was declared to celebrate the economic and social achievements of workers.

In the U.S. job losses totaled 2.6 million in 2008.Most of the job losses were in the private sector as companies slashed payroll in large numbers to weather the downturn. Since the recession began in December 2007, the economy has lost about 6.9 million jobs. In August the official unemployment rate stood at 9.7%.Millions of workers in the private sector have seen their jobs disappear and are now surviving with the help of unemployment benefits which has been extended many times. Some of the state and local government workers have also been laid off. However their numbers are much lower than the total private sector job losses. One of group of workers who have been shielded from the recession has been the Federal workers. Unlike the state and local governments which depend on taxes and other revenues to pay workers, the Federal government has the exclusive authority to print money. Hence despite the rising deficit that runs in the trillions, the Federal government has been able to keep their employees well paid.For Labor Day 2009 celebrations, the Department of Labor site tag line says “Good Jobs for Everyone”.

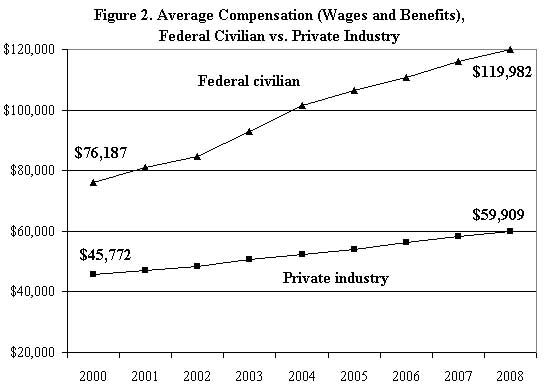

Today Federal workers enjoy much higher compensation packages relative to private sector workers. In an article titled”Federal Pay Continues Rapid Ascent” Chris Edwards of the Cato Institute analyzed the compensation levels of Federal workers using data from the The Bureau of Economic Analysis.

The article mentioned:

“The George W. Bush years were very lucrative for federal workers. In 2000, the average compensation (wages and benefits) of federal workers was 66 percent higher than the average compensation in the U.S. private sector. The new data show that average federal compensation is now more than double the average in the private sector.

In 2008, federal worker compensation averaged a remarkable $119,982, which was more than double the private sector average of $59,909. ”

Chart

Click to enlarge

Source: The Cato Institute

The above chart clearly shows that the federal wages are increasing year after year at an astonishing rate when compared to the stagnant to small rises in the private sector. As for the reason behind this great divergence, Chris added:

“Members of Congress who have large numbers of federal workers in their districts relentlessly push for expanding federal worker compensation. Also, the Bush administration had little interest in fiscal restraint, and it usually got rolled by the federal unions. The result has been an increasingly overpaid elite of government workers, who are insulated from the economic reality of recessions and from the tough competitive climate of the private sector.”

In addition to the prestige that goes with working for the Feds, Federal workers also enjoy very high security. In order to pay for such lavish pay and other benefits, the Feds adding more debt each year to the public debt which will be a burden on our future generations.In addition, anyone who has used the services of Federal government knows the excessive fees charged for any kind of services such as passport issuance, security charges when buying airline tickets, etc.

So how many people are employed by the Federal government?. According to the latest available data, there were 2,730,050 in 2007. These employees were paid $14,426,625,181 in December 2007 alone.

The Total Federal Government Civilian Employment 2007 by Function:

[Table=176]

Department of Homeland Security Agencies Total:

[Table=177]

Source: The Census Bureau

For the excellent pay and benefits, in the current economic environment, public sector jobs have become highly attractive to many people looking for work. With health care costs soaring every year and compensation for workers in the private sector not rising to keep up with rising costs, working for the government has become fashionable again.

The importance of the federal benefits was recently underscored by a U.S. Senator. During a townhall in Waukon, Iowa, a constituent asked Sen. Chuck Grassley (R-IA) “Why is your insurance so much cheaper than my insurance and so better than my insurance?â€. When Grassley struggled to explain the details of his own health care plan, the man followed up, “Okay, so how come I can’t have the same thing you have?†Grassley replied, “You can. Just go work for the federal government.â€

In summary, my answer to the title of this article is Yes, The federal government must cut the lavish benefits and pay of its employees to match the current pay levels in the private sector. Though there may not be a political will to do this, a program to gradually reduce and eliminate some of the liberal benefits offered to federal workers has to be implemented.

As the world’s largest country in terms of area Russia also has the world’s largest reserves of many natural resources. The country is blessed with an abundant supply of oil, natural gas, gold, diamond and other resources. In fact these resources exceed the reserves of commodity producing countries like Canada and Australia. However the vast majority of Russian resources remain untapped. Since the disintegration of the USSR, some of its vast energy assets have been exploited to meet the growing demands of overseas markets especially Europe. Today Russia is one of the largest producers of oil and natural gas in the world earning the title “energy superpower”.

As the world’s largest country in terms of area Russia also has the world’s largest reserves of many natural resources. The country is blessed with an abundant supply of oil, natural gas, gold, diamond and other resources. In fact these resources exceed the reserves of commodity producing countries like Canada and Australia. However the vast majority of Russian resources remain untapped. Since the disintegration of the USSR, some of its vast energy assets have been exploited to meet the growing demands of overseas markets especially Europe. Today Russia is one of the largest producers of oil and natural gas in the world earning the title “energy superpower”.