After Brazil, Chile is the one of the attractive destination for overseas investors. While Chile’s economy is primarily a commodity-based economy, there are many other factors that favor Chile.

From a recent report by OECD:

“Chile has managed the crisis better than other small open economies ,†said OECD Secretary-General Angel GurrÃa. “Thanks to sound fiscal policies and good monetary policy management during the boom years, there was room for decisive stimulus measures which are now proving their worth.â€

The following are some of the reasons to invest in Chile:

- Chile is on its way to become the 31st member of OECD

- The economy is expected to grow 4.1% this year and 5.0% in 2011

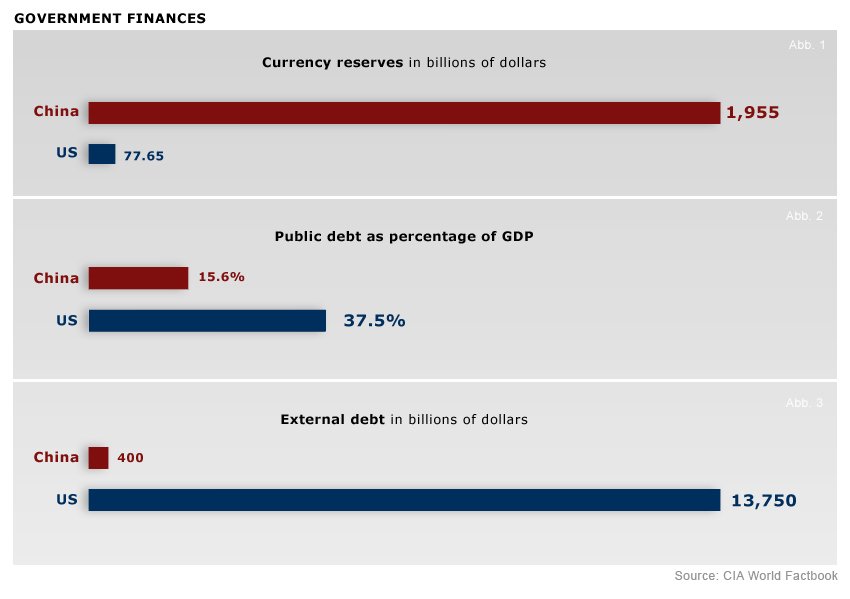

- Chile has low debt

- In 2009, Chile was number 5 in the Economic Freedom of the World Report, ahead of the U.S.

- Corruption is very minimal

- Chile has a liberal capital market and stable financial system

- Follows free trade economic policies

- Last month, Sebastian Pinera, the country’s first democratically elected conservative leader in more than half a century was elected

- Chile is the largest producer of copper in the world

- The Total Government Expenditure is low

The easiest way to invest in Chile is via the iShares Chile ETF (ECH). Financials constitute under 10% in this ETF. The fund has an asset base of $380M and has 32 holdings. Another way to invest is to pick some of the Chilean ADRs trading in the US markets. The list of Chilean stocks can be found here.