The balance sheets of major global central banks have ballooned in the past few years as they continue to borrow to keep the economy growing. One of the reasons for the soaring inflation can be attributed to this relentless money printing. The following is a brief excerpt from an interesting piece I came across recently:

So what has caused the big recent spike in inflation?

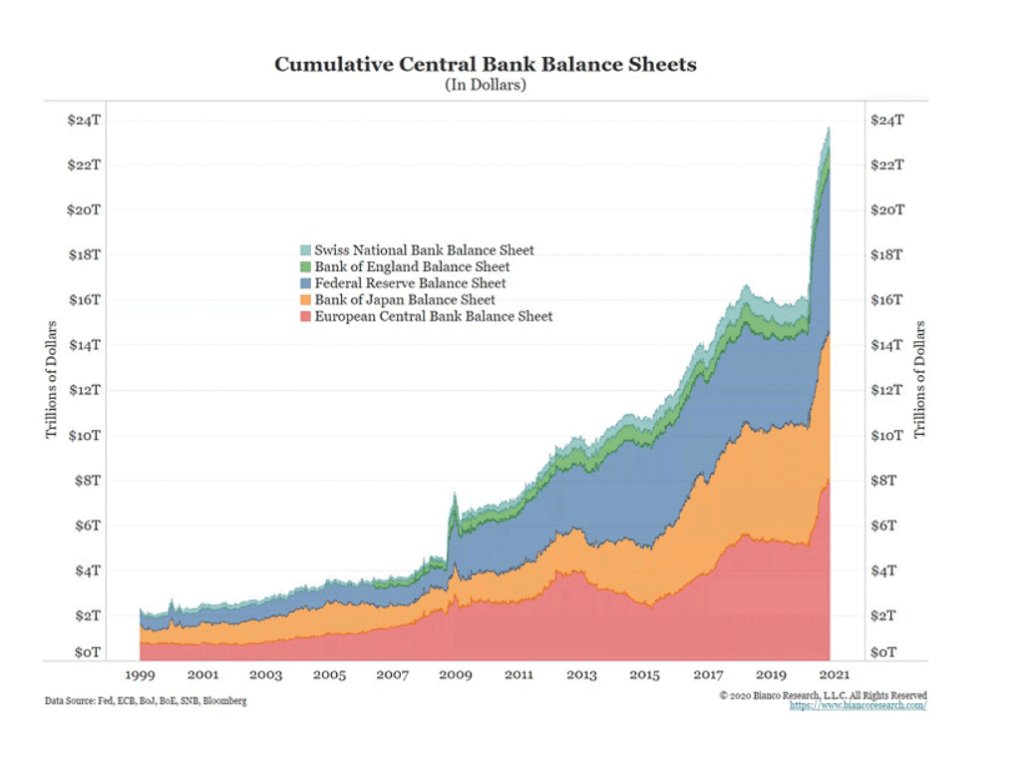

As much as President Biden would love to call this “Putin’s price hike” and Labour want to call this the “Tory cost of living crisis” the origins are much bigger. How big? How does $24 Trillion bigger sound? Is that big enough?

This chart below is now a little old but the total numbers haven’t really come down yet. The chart below is effectively money printing. To describe this in a very simplified manner the central banks print money and use that to buy government bonds and other assets that it then puts on its balance sheet. The theory is it swaps cash for bonds and subsequently releases the cash into the financial system to be loaned out, paid out as benefits etc, ending up in the consumer or business’s pockets.

Since Alan Greenspan started this economic experiment in 1999 global central banks have convinced themselves that more is better when it comes fixing global economic problems with more cash. And each new problem that has arisen, they have arrived faster and with more stimulus than the previous time. Why? The same reason Roman Abramovich kept changing Chelsea managers. Because it’s worked every time. Until it doesn’t.

Let’s look back at some examples over the past 20 years. In 2008 the global financial system nearly came to a grinding halt and was only saved by the liquidity injection we can see above. Between 2010 and 2015 a number of European countries defaulted (or almost defaulted) on their debt and were only saved because the European Central Bank “did whatever it takes” to save them. Then the Covid crash of March 2020 saw the coordinated global shutdown of the world’s economies – again only saved by an enormous injection of cash into the system.

Time and time again we have hit major financial problems and time and time again printing more money has saved the system with very little consequence – until now.

The consequences of printing more money go back hundreds, almost thousands of years. From Roman emperors shaving the sides off their silver coins to Henry VIII debasing the amount of gold and silver for cheaper metals to the German government of the Weimer Republic printing almost unlimited banknotes, Governments and Kings have found the allure of “free money” too easy resist – and each time has not exactly ended well.

Source: Inflation: The how, why and what next, Permanent Wealth Partners

Update (1/2/23):

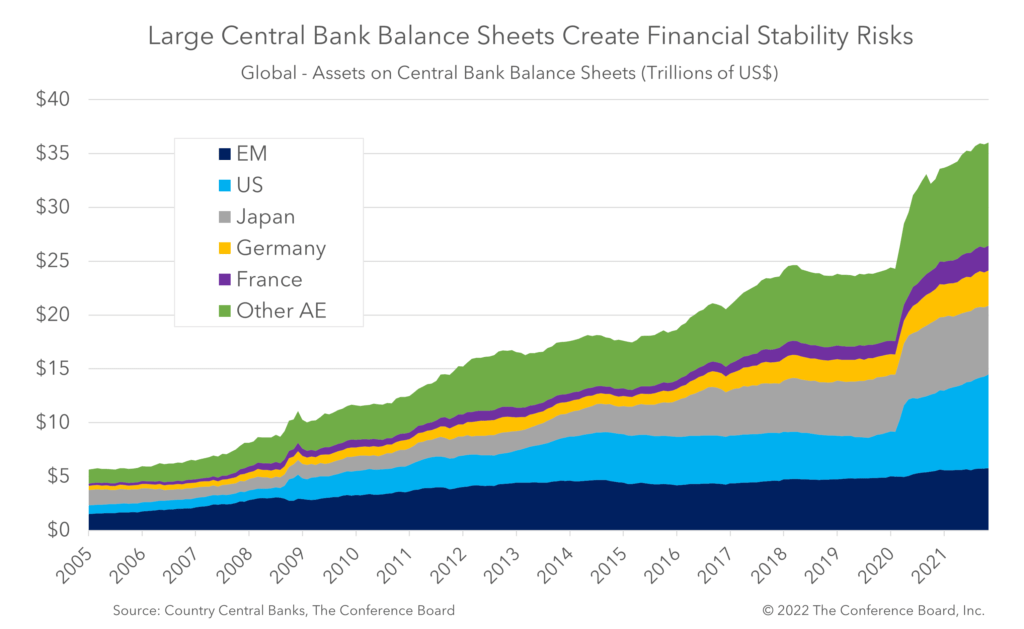

1.Central Banks Balance Sheets 2005 to 2021:

Source: Big Balance Sheets Can Mean Big Risks, The Conference Board

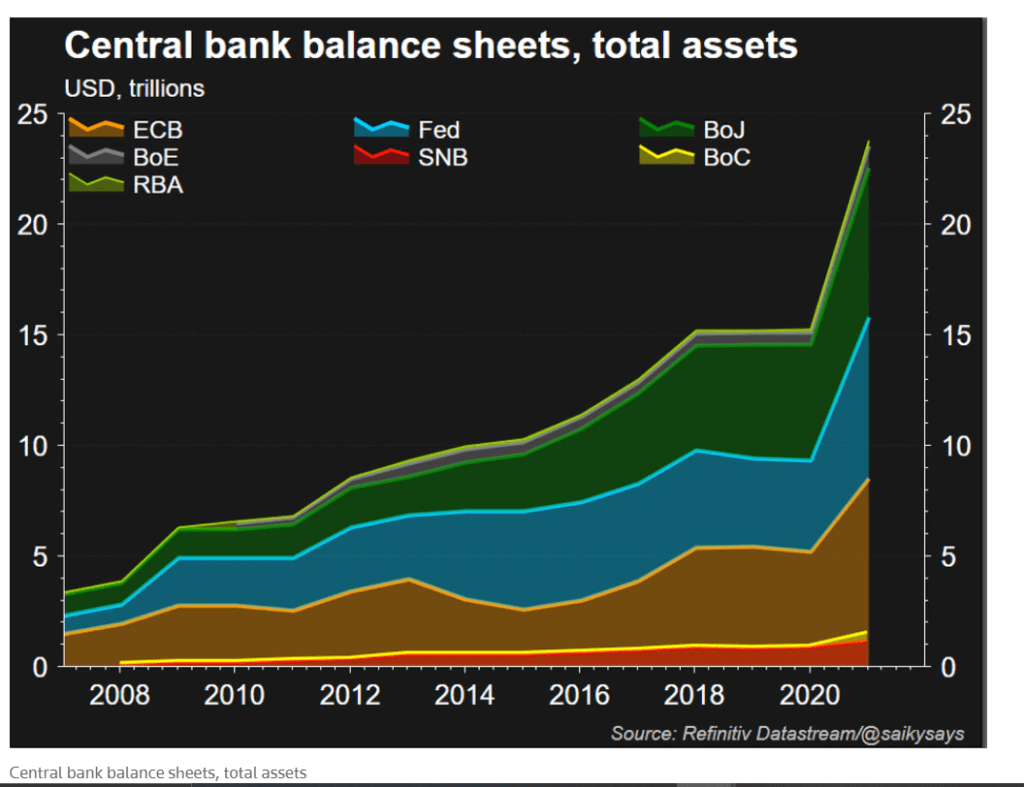

2.Central Banks Balance Sheets 2008 to 2021:

Source: Central banks start turning off the cash taps, Reuters

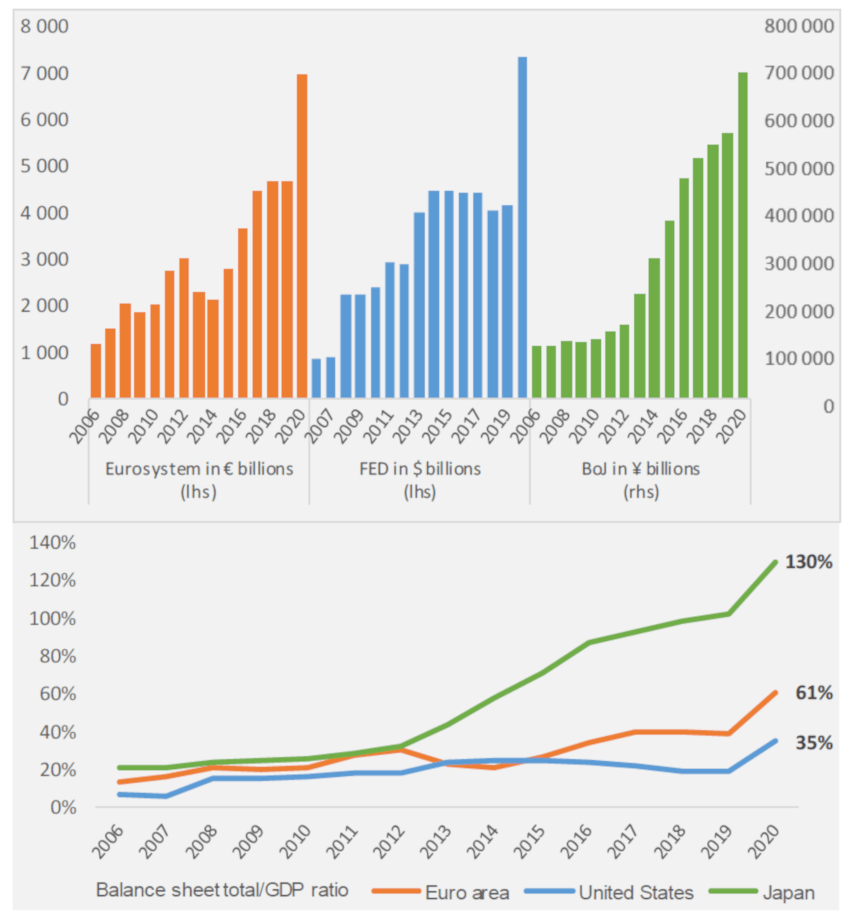

3.Balance Sheet of Central Banks 2006 to 2020:

Source: Bank of France

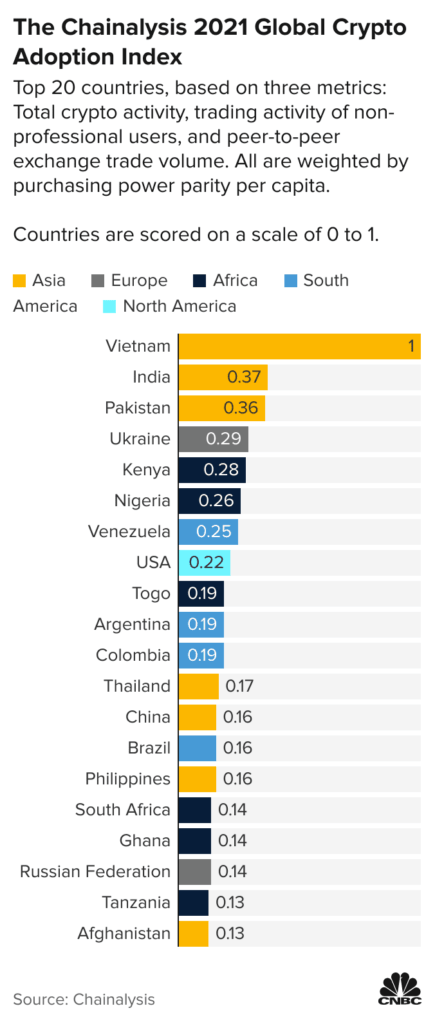

4.The Chainalysis 2021 Global Crypto Adoption Index:

Source: Why I’m Less Than Infinitely Hostile To Cryptocurrency by Scott Alexander