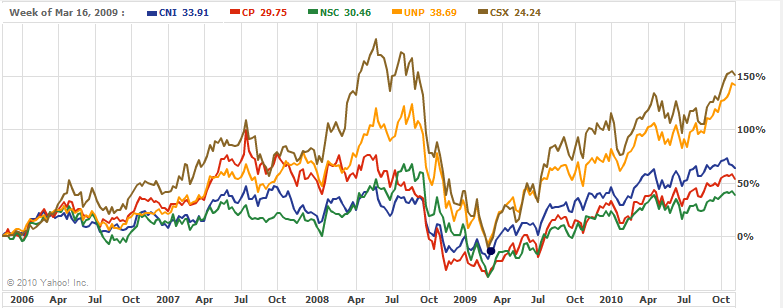

The chart below from Yahoo Finance shows the performance of the major North American railroad stocks over the past five years:

Click to enlarge

US-railroad CSXÂ Corp (CSX) is the best performer with a growth of about 150% followed by Union Pacific (UNP). Of the two Canadian railroads, Canadian National (CNI) has performer better than Canadian Pacific (CP). It must be noted that Microsoft’s Bill Gates is the largest shareholder in Canadian National. His Cascade Investments LLC owned over 34 million shares of CNI at the start of 2009. CNI is also one of the largest 20 holdings in the portfolio managed by Cascade. All five stocks have recovered nicely from the March 2009 lows.

Disclosure: Long CSX, NSC, CNI