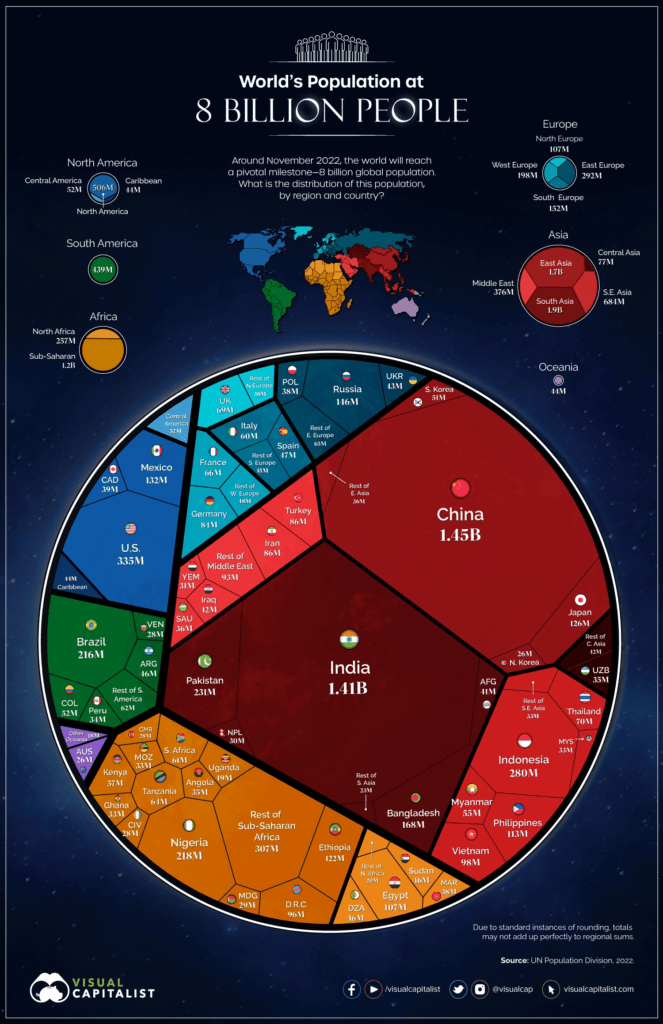

In November, 2022 the world’s population is projected to reach 8 billion according to the UN. Next year India is expected to surpass China in population as well. The following infographic from Visual Capitalist shows where these 8 billion will live:

Click to enlarge

Source: Visual Capitalist