- Executive Pay Gluttony (Barry) (Gluttony is a sin. So.. 🙂 )

- Bubble risk grows as China’s stock boom defies gravity (Business Line)

- Vietnam War 40 Years Later: Capitalism Trumps Ideology (Common Dreams) See also 30 April 1975: North Vietnamese forces capture Saigon (MoneyWeek)

- The Day Wall Street Changed (Jason Zweig, WSJ)

- Stick with the Winners (The Financilist)

- Opinion: Five reasons why Greece won’t exit the euro (DW)

- Why Mother India heads emerging market pack (Money Observer)

- Is long-term earnings inequality growing? Evidence from German baby-boomers and their parents (OECD Observer)

- Seven years on, RBS has yet to escape the grim shadows of the past (The Telegraph)… Still they call it “Royal” Bank of Scotland..

Healthcare Systems: U.S. vs Other Developed Countries

It has been many months since I wrote an article on the U.S. healthcare system. In this post lets take a look at how the U.S. system compared to 11 other developed countries.

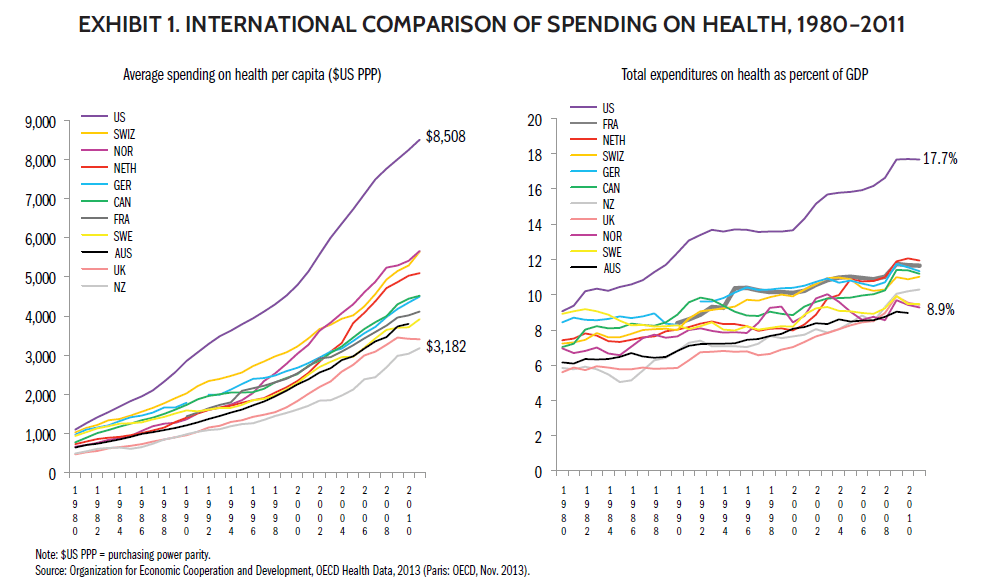

According to a report published in June last year by The Commonwealth Fund, the U.S. ranks last overall. This won’t be shock to anyone if the U.S. had the cheapest healthcare system and spent the lowest in the world. However the exact opposite is true. The country spends the most on healthcare as a percentage of GDP. In addition, the average spendingon health per capita is also the highest as the chart below shows:

Click to enlarge

However despite this high spending the outcomes are not the best. In fact, they are very low based on many measures.

According to the authors of the report, the claim that the U.S. has “the best health care system in the world” is clearly not true.

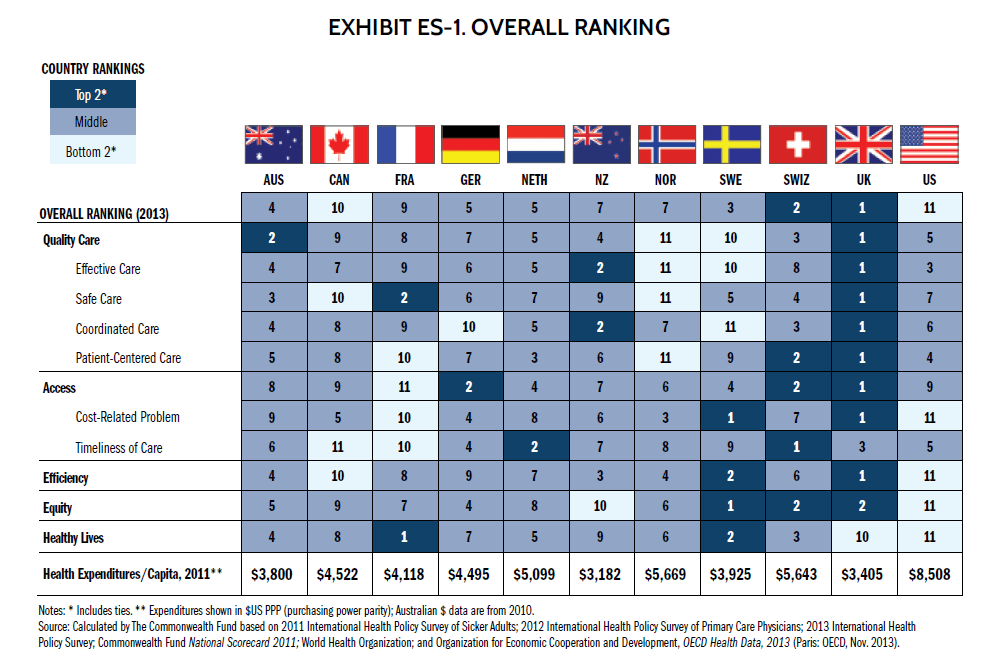

The following graphic shows where the U.S. stands compared to other countries in terms of overall ranking:

The chart below shows the ranking based on various individual measures:

From the report:

The most notable way the U.S. differs from other industrialized countries is the absence of universal health insurance coverage.5 Other nations ensure the accessibility of care through universal health systems and through better ties between patients and the physician practices that serve as their medical homes. The Affordable Care Act is increasing the number of Americans with coverage and improving access to care, though the data in this report are from years prior to the full implementation of the law. Thus, it is not surprising that the U.S. underperforms on measures of access and equity between populations with above- average and below-average incomes.

The U.S. also ranks behind most countries on many measures of health outcomes, quality, and efficiency. U.S. physicians face particular difficulties receiving timely information, coordinating care, and dealing with administrative hassles. Other countries have led in the adoption of modern health information systems, but U.S. physicians and hospitals are catching up as they respond to significant financial incentives to adopt and make meaningful use of health information technology systems. Additional provisions in the Affordable Care Act will further encourage the efficient organization and delivery of health care, as well as investment in important preventive and population health measures.

Source: Mirror, Mirror on the Wall, 2014 Update: How the U.S. Health Care System Compares Internationally, The Commonwealth Fund

Knowledge is Power: Christian Ethic, The Stans, Share Buybacks Edition

- Canada vs. the U.S.: Whose retirement grass is greener? (Financial Post)

- The Christian Ethic... (The Hindu)

- The economic miracle that isn’t …On South Africa (Le monde)

- How much do you know about ‘the Stans’ of central Asia? – quiz (The Guardian)

- Progressive Finnish fines for traffic tickets? (Marginal Revolution)

- Many investors could do more to reduce their taxes (Vanguard Blog)

- A profile of Europe’s populist parties: Structures, strengths, potential (DB Research)

- Do Away with Sell in May (McLean & Partners)

- Share buybacks: Robbing Peter to pay Paul (EuroMoney)

Found this in a Cemetery…..:-)

When Building a Portfolio of Individual Stocks Diversification is Very Important

Investing in individual stocks is the most common way for investors to build a portfolio. However individual stocks are inherently risky to hold for a variety of reasons. Some of the risks with holding stocks include:

- There is no guarantee that a would an investors would go up. It is perfectly possible for any stock to go down or an investor to hold that stock for many years with flat or even negative returns.

- Dividends paid by a firm on its common stock can be suspended or cut any time for any reason. Dividends are completely discretionary and a company can decide to eliminate it for whatever reason. Since ordinary investors do not have a say in how companies are run they are at the mercy of the CEO and the board running the firm on a daily basis.

- Investors do not have all the information of a company’s inner workings. For example, despite quarterly reports and other reports filed by firms, not all the information is widely and publicly shared. So if a massive fraud is going on with accounting inside a company investors will be in dark until it unravels publicly. Only a handful of people in the firm would have knowledge about such things.

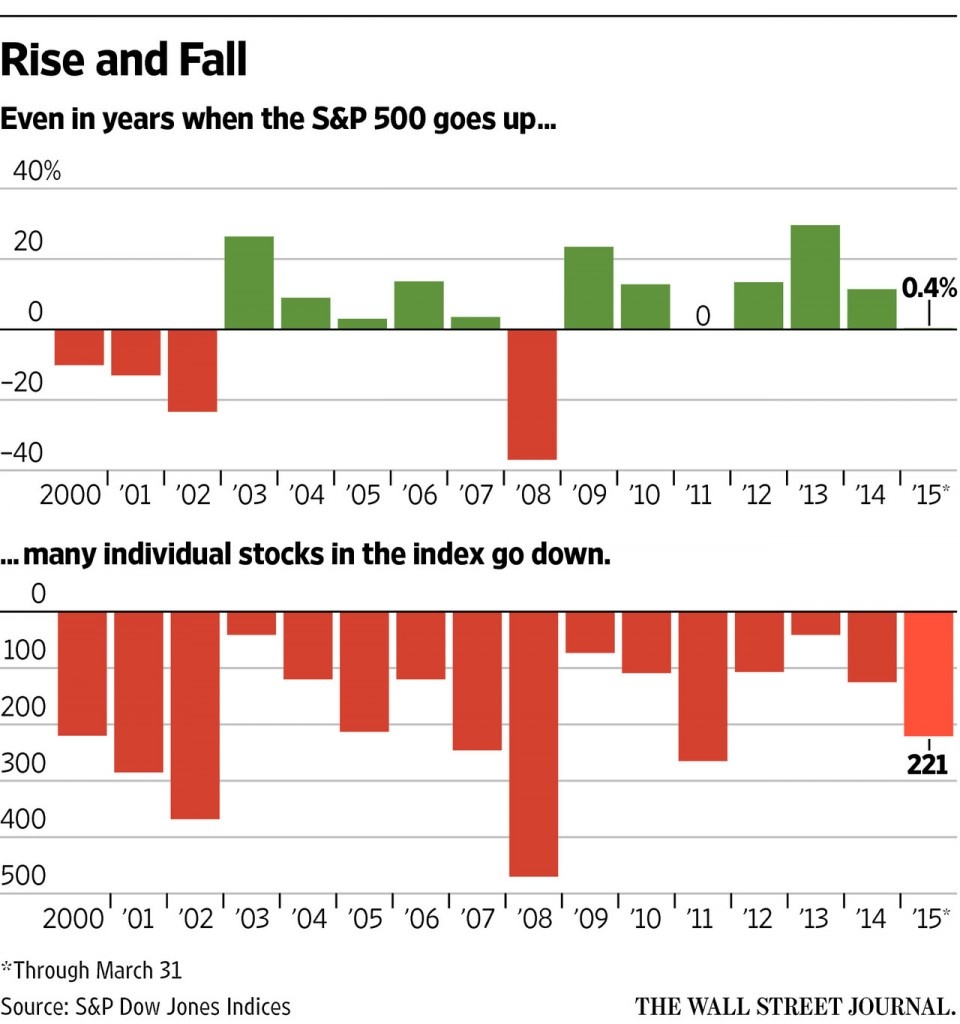

- Another reason individual stocks are risky is that though the whole market may go up the stock one holds may not necessarily go up. So one holds a portfolio of such stocks they will be out of luck.

The following chart from a recent journal article shows this phenomenon:

Click to enlarge

Source: The Trap of Trying to Pick Individual Stocks, by Liam Pleven, Apr 3, 2015, WSJ

From the WSJ article:

Investors could be easily dazzled by the current stars of the stock market and tempted to ditch boring index funds for a piece of the action.

Twitter shares have gained 41% this year through Thursday. Apple is up 14%, after rising for six years in a row. Shares of Kraft Foods Group have shot up 45% since March 24, the day before a proposed merger with H.J. Heinz was announced.

Not bad in a year when the S&P 500 is up less than 1%.

But consider this sobering fact: Even when the market is up, many stocks drop. Last year, when the S&P was up 11%, 125 stocks in the index fell, says S&P Dow Jones Indices.

As the example shows above, diversification is very important when building a portfolio of equities. The following is another example that shows the importance of diversification.

The S&P 500 fell by 37% in 2008 during the global financial crisis of 2008-2009. But even during that time there were some stocks that actually went up while many stock plunged with some falling over 90% or disappearing altogether.

Click to enlarge

Source: The aristocratic investor (and Downton Abbey spoilers) by Andy Clarke, Vanguard Blog

In summary, the key to successful investing in equities is to select and build a portfolio of high-quality stocks and hold them for the long-term.It is never a wise idea to put all the eggs in one basket.

Disclosure: No Positions