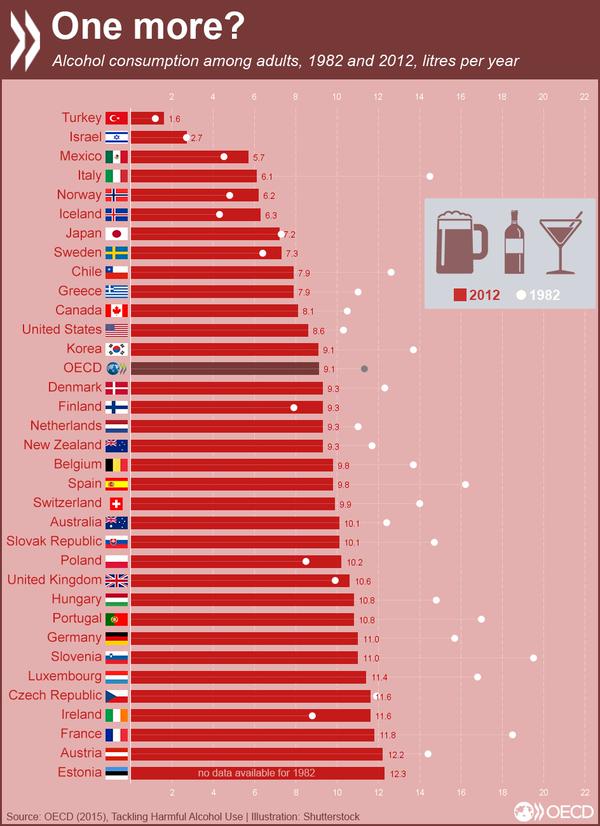

Alcohol consumption is high in most European countries compared to the U.S. However Russia is one of the top alcohol consuming countries in the world but is not in this chart since it is an OECD country. If Russia is included it will top out all the countries.

Click to enlarge

Source: Tackling Harmful Alcohol Use, OECD post on Twitter