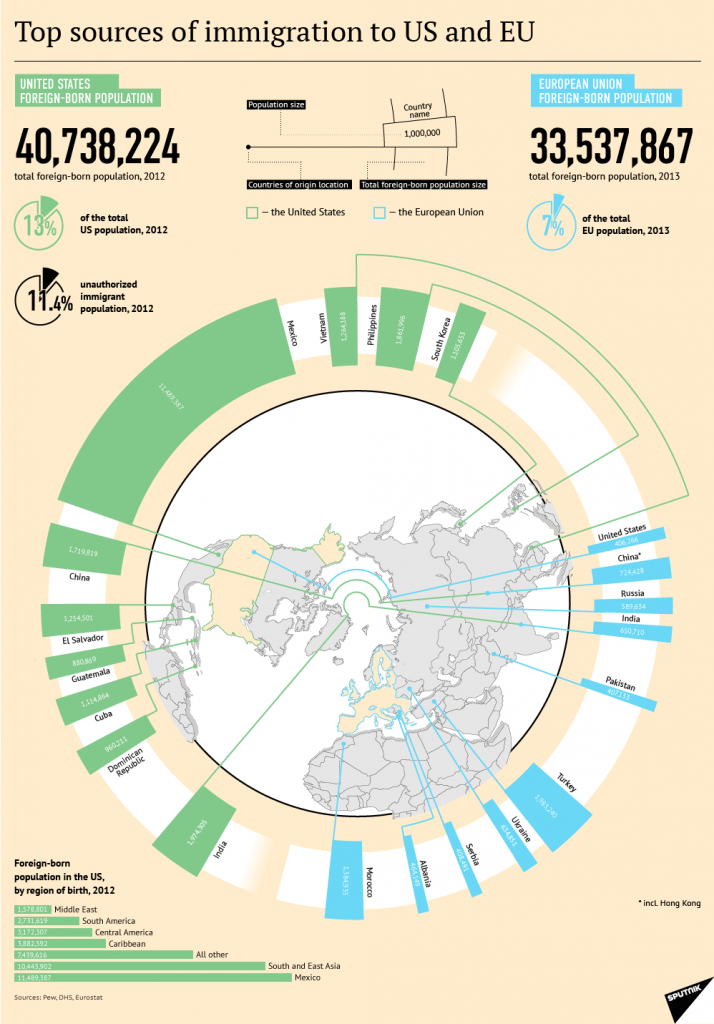

Mexico is the top source of immigrants to the USA while Turkey is the top source of migrants to the EU. Turkey is a relatively well-off country compared to Morocco for example but still Turks immigrate to the EU. Though thousands of migrants from African and other poor countries pour into the EU these days in search of jobs and a better life, the reality is that most rich European countries themselves are suffering from a stagnant economy. However all the developed European countries offer liberal social benefits to all which also applies to immigrants as well. So immigrants have a chance to survive until they can get back on their feet.

Click to enlarge

Source: Sputnik News