In an earlier article I discussed about the decline in the dividend payout ratios of U.S. companies. In this post let us take a look at how dividend payout ratios in the emerging markets compare to that of U.S. dividend payout ratios.

Many investors in the developed world have the misconception that emerging market equities are not great dividend payers. However that is not entirely true.There are plenty of emerging stocks that have decent dividend yields that are comparable to their peers in the developed world. Some of these emerging companies even have higher dividend growth rates. In general unlike the developed markets, emerging markets have a much bigger universe of companies to choose from and companies are growing and competing fiercely in order to attract investors’ capital. One way some of these firms compete is by sharing a higher portion of their earnings with shareholders by establishing strong dividend payout policies and following them. In fact, some of the firms in Asia that did not pay a dividend before are starting to pay dividends as they embrace the dividend culture that is common in developed markets. As more and more companies from developing countries become global multinationals and their profits grow, they are highly likely to reward shareholders by increasing their dividend payout ratios.

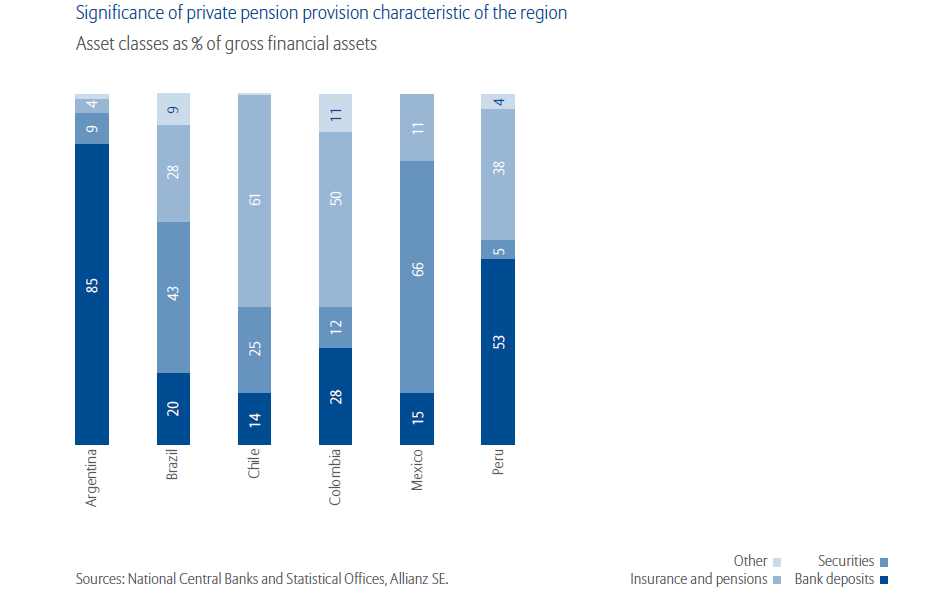

Investors may be surprised to learn that dividend payout ratios of emerging markets are comparable to that of the U.S. dividend payout ratios as represented by the S&P 500 and MSCI Emerging Markets Index.

Click to enlarge

Source: Dividend Growth in Emerging Markets, Emerging Global Advisors

Hence investors looking to add dividend stocks can also consider emerging market dividend stocks. This does not mean investors should rush into these stocks. Since emerging markets will always be more volatile than developed markets and they are riskier it is wise to allocate only a small portion of one’s income part of a portfolio to emerging stocks.

Developing markets such as Chile, Taiwan, South Africa , etc. are better for dividends than others such as South Korea or Russia. In addition to country selections, it is also important to be highly selective when hunting for income stocks in developing markets.

Ten dividend stocks from emerging markets are listed below to consider for potential investment opportunities:

1.Company: Standard Bank Group (SGBLY)

Current Dividend Yield: 4.39%

Sector: Banking

Country: South Africa

2.Company:Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 2.48%

Sector: Semiconductors & Semiconductor Equipment

Country: Taiwan

3.Company:China Mobile Limited (CHL)

Current Dividend Yield: 3.37%

Sector: Telecom

Country: China

4..Company:Banco Santander- Chile (BSAC)

Current Dividend Yield: 4.44%

Sector: Banking

Country: Chile

5.Company: China Petroleum & Chemical Corp. (SNP)

Current Dividend Yield: 4.33%

Sector: Oil & Gas

Country: China

6.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 2.78%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

7.PT Telekomunikasi Indonesia Tbk (TLK)

Current Dividend Yield: 2.90%

Sector: Telecom

Country: Indonesia

8.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.66%

Sector: Electric Utilities

Country: Chile

9.Company: CPFL Energia SA (CPL)

Current Dividend Yield: 5.59%

Sector: Electric Utilities

Country: Brazil

10.Company:Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 3.88%

Sector: Telecom

Country: Philippines

Note: Dividend yields noted above are as of Sept 26, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long UGP