Globalization has become a major topic of discussion and analysis for media and individuals alike in recent years. After a few decades of accepting the process of globalization as being the “new normal” many are now starting to question the concept. The recent election of President Trump is in due in part to voter’s reject of a globalized economy where jobs are moved to the lowest cost countries. Similarly last year in the UK, people voted in favor of Brexit shocking the ruling elite. While globalization has brought many benefits to many millions over the years it has also created a huge division among countries – with distinct sets of winners and losers.

A recent article by Larry Elliott at The Guardian discussed about the current and future state of globalization. From the article:

The received wisdom for Davos is that this isn’t a tipping point. Globalisation, it was asserted, is really being driven by technological change over which politicians have little control. Supply chains cross borders, often many times over. Consumers care more about whether the goods they can order online will be delivered the next day than where they are sourced from. Douglas Flint, chairman of HSBC, cited the example of the taxi app Uber as a disruptive technological change that was here to stay.

he globalisation optimists may well be proved right. Unravelling the complex web of international links that have been established since the Berlin wall came down at the end of 1980s would be a long and painful process. Pascal Lamy, once the EU trade commissioner and a former director-general of the WTO, scoffed at the idea that the world had reached a tipping point and said the recent slowdown in global trade was only to be expected after years of rapid growth.

Roberto Azevedo, the current WTO boss, said: “One difference between the 2008 financial crisis and the 1930s is that today we have multilateral rules and the 1930s did not.”

The Brazilian noted that the tit-for-tat protectionism resorted to during the Great Depression resulted in world trade shrinking by two-thirds in three years. “That would be a catastrophe of unimaginable proportions.”

Christine Lagarde, managing director of the International Monetary Fund, said that if Trump went ahead with his trade agenda, it would undo all the growth benefits from his tax cuts and infrastructure spending – and then some. The hope at the big international organisations – the IMF, the World Bank and the OECD – is that the new president will quickly work out that there are downsides to putting a 45% tariff on Chinese goods: higher consumer prices and retaliation, to name but two.

That said, supporters of free trade have been their own worst enemies. They knew from the outset that globalisation creates losers as well as winners, but have done little or nothing to ensure that the benefits of greater liberalisation have been equitably shared. In recent years the losers have increased in number – and become more vociferous.

Source: Globalisation once made the world go around. Is it about to grind to a halt?, The Guardian, Jan 21, 2017

So which countries benefited the most from globalization?

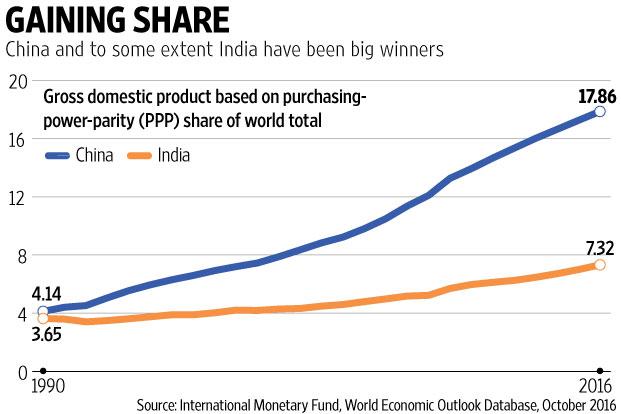

Two countries that are the biggest beneficiaries of globalization are China and India. China’s share of world Gross Domestic Product (GDP) increased from 4.1% in 1990 to an astonishing 17.86% by 2016 measured in terms of purchasing power parity. Or to put it another way China accounted for nearly one-fifth of the world’s economic output last year. This is indeed incredible considering that the country was largely a poor and undeveloped only a few decades ago. The main reason for this phenomenal growth of China’s economy is globalization. As China became the factory floor of the West, the economy prospered lifting millions out of poverty.

Click to enlarge

Source: Which countries have benefited the most from globalization?, Live Mint

India also benefited from globalization with its share of the world output rising from 3.6% in 1990 to an estimated 7.3% in 2016. Though the rate of increase is not as high as China’s, it is still a respectable achievement. Again globalization is the driver behind this growth.

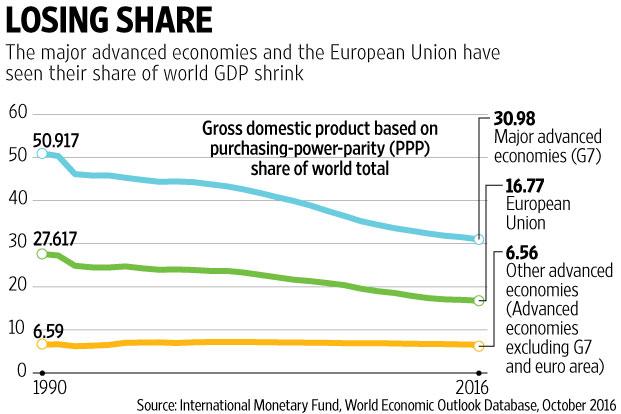

Which countries are the losers from globalization?

The following chart provides the answer to the above question.

Click to enlarge

Source: Which countries have benefited the most from globalization?, Live Mint

For example, the share of the G-7 countries from the world’s output fell from more than 50% in 1990 to 30.9% in 2016. The G-7 countries are Canada, France, Germany, Italy, Japan, UK and US.