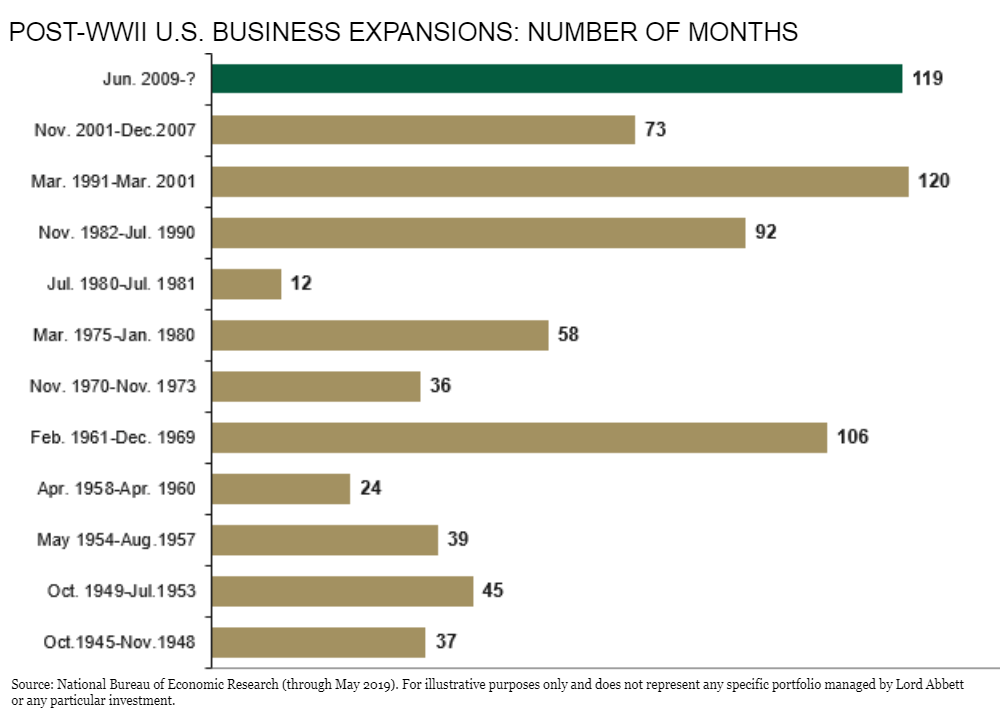

The chart shows the many periods of business expansions in the US since World War II. The current expansion that began during the depths of the GFC in 2009 is one of the longest on record lasting over 100 months. The previous long bull market was during the golden age of hi-tech from 1991 to 2001 when all things technology including dot coms were hot.

Click to enlarge

Source: Lord Abbett