American investors looking for income stocks can consider going abroad for investment opportunities. While the US equity market offers decent dividend yields, foreign stocks have better yields. So instead of purely focusing on domestic stocks, adding overseas companies not only provides additional yields but also diversification benefits to a well built portfolio.

Though investors are subjected to unique risks with foreign dividends such as currency exchange risks, dividend withholding taxes, political risks, etc. it is possible to come out ahead by owing overseas stocks. For example, the Australian equity market offers more than double yield of the US market. So despite the issues mentioned above investors can generate a substantial higher yield from owning Aussie stocks.

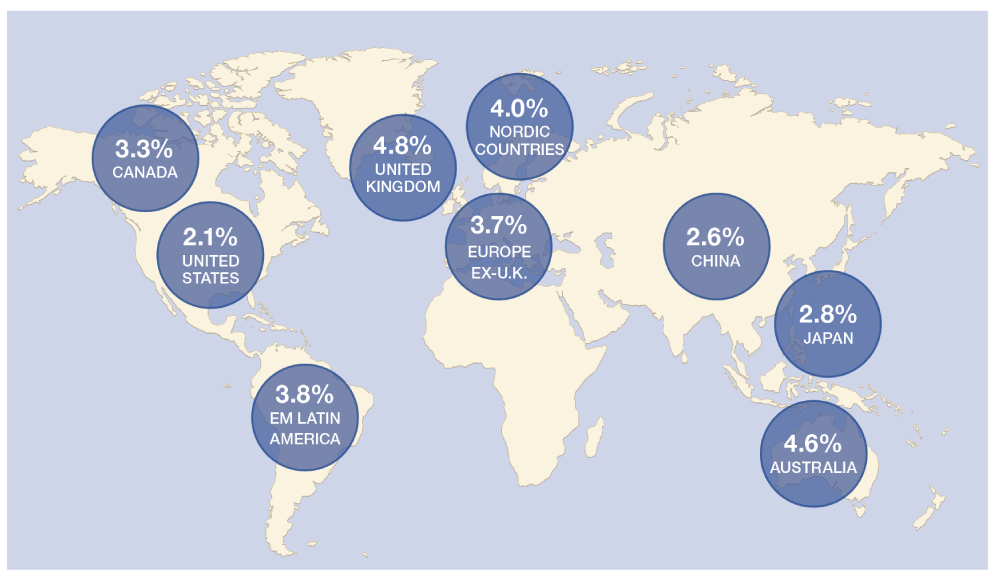

The following chart shows the dividend yields of major foreign markets/regions:

Click to enlarge

Note: Data shown is 2019 estimates as of 6/30/19

Source: Rethinking Your Income Strategy? by Michael Ordonez, Thornburg Investment Management

Ten foreign dividend stocks to consider for further research are listed below with their current dividend yields:

1.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 4.02%

Sector: Banking

Country: Canada

2.Company: BCE Inc (BCE)

Current Dividend Yield: 4.92%

Sector: Telecom

Country: Canada

3.Company: National Grid PLC (NGG)

Current Dividend Yield: 5.73%

Sector:Multi-Utilities

Country: UK

4.Company: Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 4.79%

Sector:Telecom

Country: Australia

5.Company: Eni SpA (E)

Current Dividend Yield: 6.35%

Sector: Oil

Country: Italy

6.Company:Equinor ASA (EQNR)

Current Dividend Yield: 5.43%

Sector: Oil

Country: Norway

7.Company: Bancolombia SA . (CIB)

Current Dividend Yield: 2.46%

Sector: Banking

Country: Colombia

8.Company: DBS Group Holdings Ltd(DBSDY)

Current Dividend Yield: 4.90%

Sector: Banking

Country: Singapore

9.Company:Commonwealth Bank of Australia (CMWAY)

Current Dividend Yield: 5.65%

Sector: Banking

ountry: Australia

10.Company: Novartis AG (NVS)

Current Dividend Yield: 3.32%

Sector: Pharmaceuticals

Country: Switzerland

Note: Dividend yields noted above are as of Oct 9, 2019. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long RY