Diversification is one of the most important strategies to follow when investing in equity markets. Putting all eggs in one basket is never a good idea. Many investors who piled into tech stocks during the dot-com era lost everything due to lack of diversification.

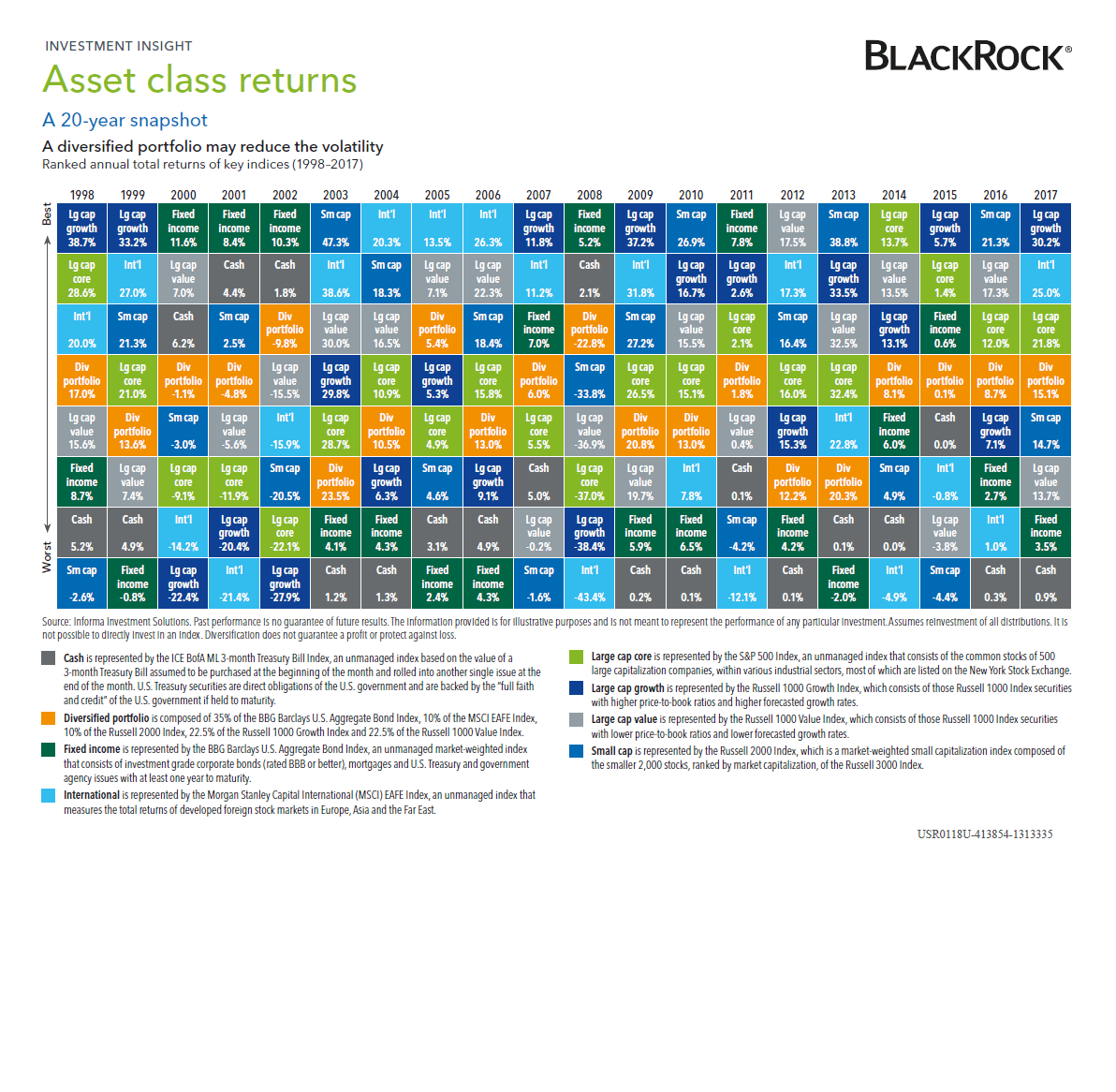

Diversification can take many forms including spreading one’s asset among various countries, regions, sectors, asset classes and asset types. The following chart shows the benefits of diversification based on US asset returns by year:

Click to enlarge

Source: Blackrock

In 2017, US large cap growth were the top performers with a return of 30.2% while fixed income was the second worst performer with a return of just 3.5%. International stocks earned the highest returns after US large cap growth at 25%. This shows the need for diversifying overseas.

Back in 2008, at the height of the Global Financial Crisis(GFC) US large cap growth and foreign stocks lost 38% and 43% respectively while fixed income yielded 5.2%.

So in a nutshell, investors need to allocate their portfolio among many asset classes. Simply owning only large caps or only fixed income is not a wise strategy.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- S&P MidCap 400 SPDR ETF (MDY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions