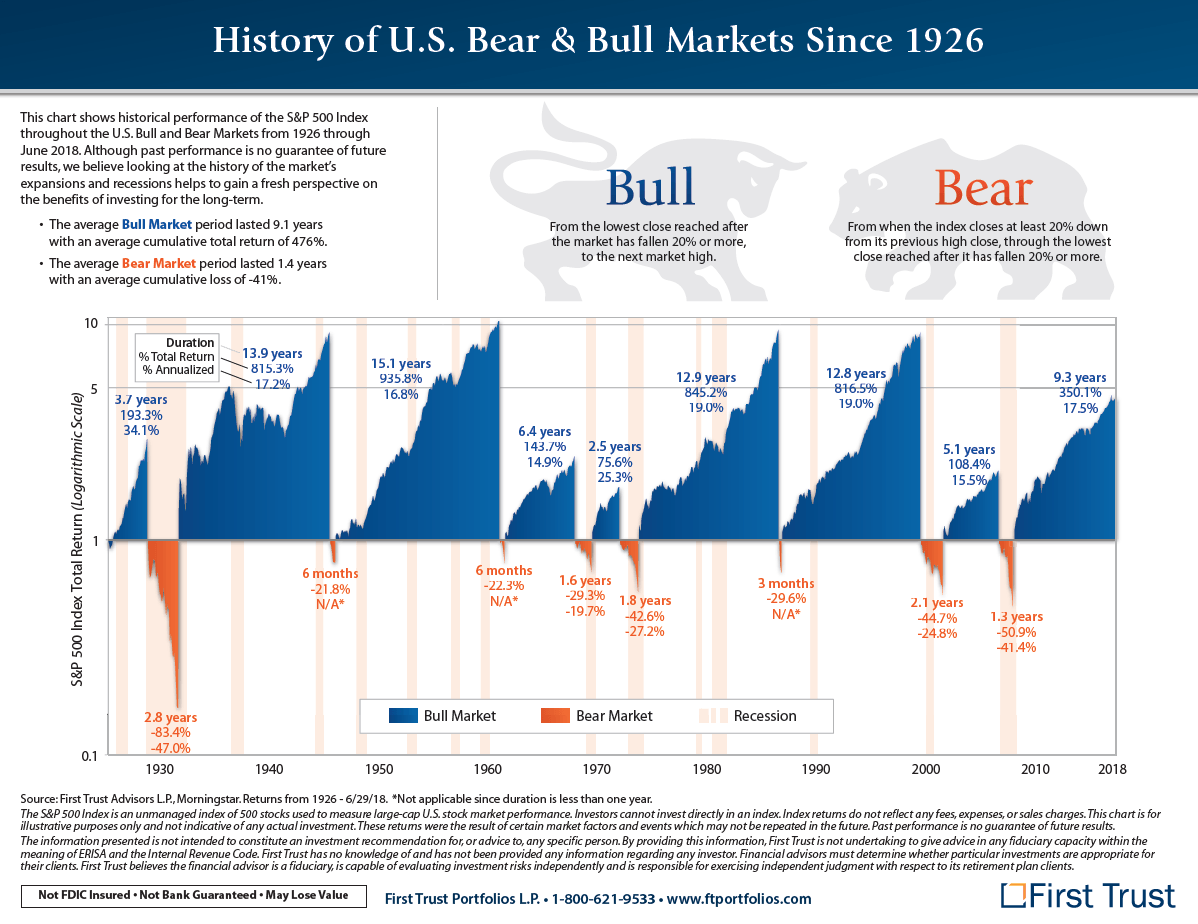

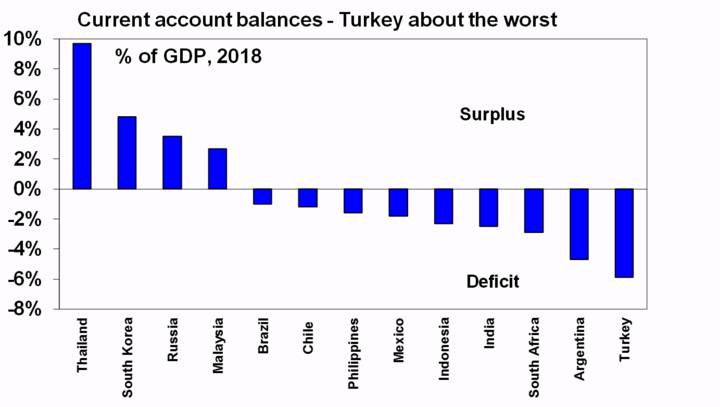

The bull market in U.S. equities since the Global Financial Crisis(GFC) seemingly remains strong despite many crises affecting the US and global economy in recent years. The most recent Turkey crisis has become another “dead on arrival” case. The question now on most investors’ mind is what is holding up US stocks so well and when will the bull get tired. Though nobody including the so-called experts knows exactly when this bull market will end, it helps to pay attention to historical performances of bull and bear markets.

I came across the following historical US bull and bear markets chart created by First Trust and posted by Barry Ritholtz at The Big Picture:

Click to enlarge

Source: First Trust